The data from Fridays's release: CFTC Commitments of Traders: Yen shorts wade back in, GBP longs stay strong

ANZ's take on the info (see below for an explanation of how ANZ look at this data):

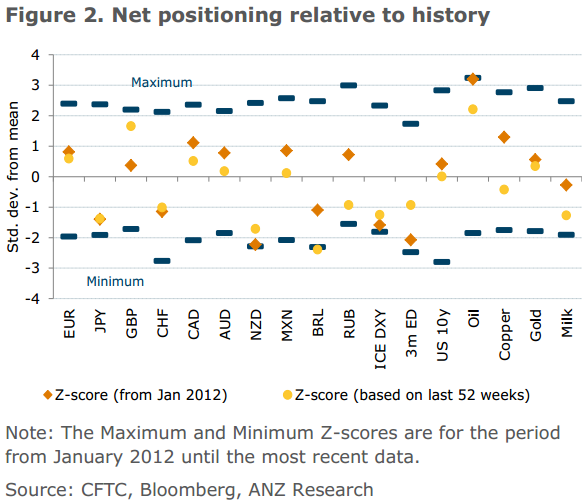

- Leveraged funds marginally pared back their net long USD position ahead of the US non-farm payrolls data

- USD was sold against all major currencies except the JPY and AUD. Funds added to their overall net short JPY position by USD0.3bn to USD10.7bn, reversing the net buying from the previous two weeks. Yen short positions continue to remain at elevated levels.

- Meanwhile, EUR and GBP saw net buying

- Commodity currencies continued to see net selling for the ninth straight week, led by the AUD. Net AUD longs were trimmed for the ninth consecutive week, by USD0.2bn to USD3.4bn. NZD however, saw net marginal buying for the first time in seven weeks. Net long CAD positions also saw a marginal uptick in the week.

- Net long crude oil and gold positions were cut in line with falling prices in the week

- Net long contracts in 10 year USTs were also trimmed as yields continued to remain volatile

-

ANZ look at the US Commodity Futures Trading Commission (CFTC) a little differently to elsewhere (any errors in this summary are mine):

- There are two reports compiled by the CFTC: the Commitment of Traders (COT) and the Traders in Financial Futures (TFF)

- The TFF report provides a richer breakdown of traders into the 'sell side' and 'buy side'

- ANZ use the parts of the TFF report (combined futures and options position of Leveraged Funds) as a proxy for leveraged positioning, where available