Currently trading at 0.8007 after touching highs of 0.8010

The 0.8000 level has been a troubled resistance level for buyers for all of last week.

Looking at the daily chart, it still presents a level that buyers will need to find a firm close above in order to build on the next leg higher. At the moment, it's still a struggle. Friday's move saw a jump up to 0.8039 but it closed the day lower at 0.7995 - again, below 0.8000.

If anything, watch out for the close today as this would be the key level buyers need to firmly stay above if they want a shot to send the pair higher. I've also mentioned this last week here too.

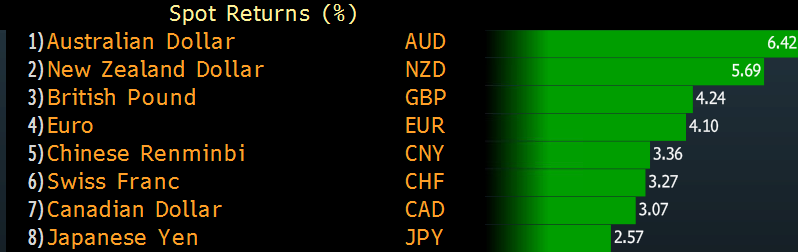

Since 11 December, the pair has only had 7/29 trading days in the red - and among the major currencies, the aussie is the top dog if you're looking for performance relative to that date:

Although further signs of exhaustion around here would give some encouragement to sellers to build on. But for now, buyers remain in control as sellers must first chew through bids centred at the 100-hour MA in order to find conviction for a move lower: