Australian Industry Group Performance of Manufacturing Index for August

We started the week with a rocket from North Korea ... ending it with a rocket from the AiG manufacturing PMI. A huge gain, up 3.8 points on the month to 59.8.

'Key findings' from the report (bolding mine):

The highest monthly result for the Australian PMI since 2002

It marked an eleventh consecutive month of expansion ... the longest consecutive run of expansion since 2007 in the seasonally adjusted series

Six of the seven activity sub-indexes expanded in August (seasonally adjusted)

- Production and new orders were especially strong (61.4 and 64.3 points)

- but they were coupled with a robust expansion in inventories (58.9 points) rather than in sales (50.9 points)

- Exports contracted mildly (49.3 points). This suggests current activity is geared towards future orders and stockpiling rather than for immediate delivery

- Employment and supplier deliveries expanded at a slower pace in August than in July.

This recovery is occurring despite the ongoing withdrawal of automotive production from Australia and is due to accelerating growth in other large sub-sectors. Seven of the eight sub-sectors expanded in August (trend)

- Only 'textiles clothing furniture and other manufacturing' contracted (46.1 points) but even this sub-sector improved from previous months

- Non-metallic mineral products (72.3 points) and wood & paper products (71.1 points) expanded very strongly in August due to local demand from the building industry and from food manufacturing and processing (for packaging products)

- Positive sources of local demand for manufacturers of chemicals, metals, machinery and equipment in August included infrastructure construction; mining (re-investing as metals prices recover); agriculture (good crops and livestock); renewables; and water utilities

- Input costs and especially energy costs are of great concern to manufacturers. The recent lift in the dollar is dampening imported input prices but also dampening export sales.

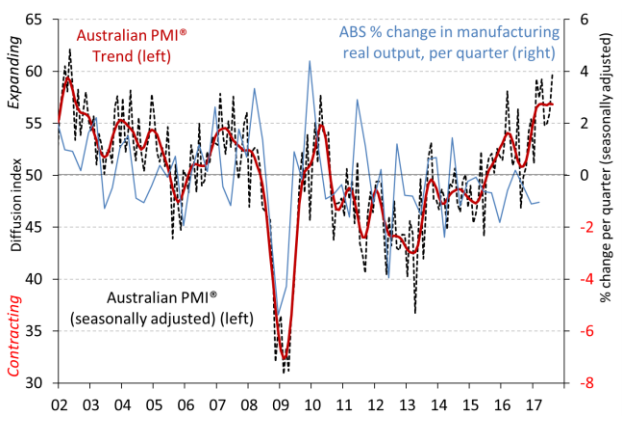

A bit of a messy graph, but the gist is a rising manufacturing PMI trend (red line) .... but I don't really see much of a relationship with the ABS change in manufacturing output. Anyone else?

--

As you can see (if you are watching) there is not much of an immediate impact on the Australian dollar. there rarely is from the PMIs. But, useful info nonetheless.

--

Earlier we got the first of the duelling manufacturing PMIs from Australia ....

If I was asked what Australia really needs I doubt I would have nominated another manufacturing PMI, but no-one did.

;-)