AiG Performance of manufacturing Index

Key points from the September report:

- September marked a twelfth consecutive month of expansion

- Longest run of expansion since 2007

In trend terms, growth is continuing but looks to have decelerated through the September quarter

- The Australian PMI® is currently leading the ABS manufacturing output data by about three months. The latest ABS estimate of manufacturing output volumes indicated growth of 1.8% q/q in the June quarter of 2017, the strongest quarter of growth since June 2011. The latest results from the Australian PMI® indicate another quarter of growth in ABS output volumes is likely in September 2017, but probably at a slower pace than in June.

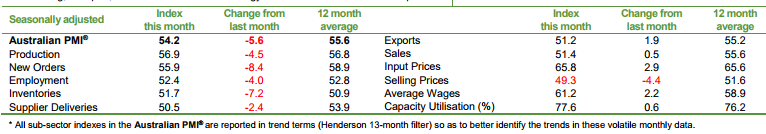

All seven activity sub-indexes expanded or were stable in September (seasonally adjusted)

- Exports recovered (rising to 51.2 points) after a mild contraction in August (49.3 points). All others expanded but at slower rate than in August.

All eight sub-sectors expanded in September (trend)

- Non-metallic mineral products (75.5 points) hit a new record high, reflecting the strength of demand for building-related products. Other large sub-sectors grew at a decelerating pace this month

Positive sources of local demand for manufacturers in September included apartment and infrastructure construction; mining and agricultural equipment; renewables and utilities. A longer colder winter reportedly contributed to increased demand for heating equipment. Respondents also reported a rare spike in exports of construction-related products for emergency relief and reconstruction in the US following recent hurricane damage. Last orders are now under way for suppliers of components to Australian automotive assembly

AUD not doing too much on the data. It rarely does on this data point.

Plenty to come from Australia this week:

--

Earlier today we got another September manufacturing PMI, from CBA/Markit:

Australia - CBA / Markit Manufacturing PMI (September) 53.8 (prior 53.5)