Australian home loan data for September is scheduled for 0030 GMT

- Home loans m/m, expected is 2.0%, prior was 1.0%

- Investment lending m/m, prior was 4.3%

- Owner-occupied loan value m/m, prior was 0.9%

Westpac preview:

- The number of owner occupier loans rose 1% in Aug, holding flat ex refinance.

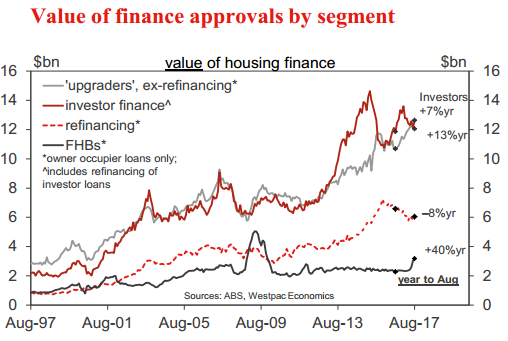

- The value of approvals to investors posted a surprisingly strong 4.3% gain although that is likely being bolstered by investor refinancing activity following macro prudential tightening in late March and associated increases in rates for 'interest only' loans (the ABS does not split out 'refi' for investor loans)

- Industry data suggests owner occupier loans posted a solid 3% rise in Sep, again suggesting the wider market slowdown evident in other measures is primarily due to a pull back in investor segments.

- Within the owner occupier group, first home buyers have also been a notably strong driver in recent months, responding to increased state government assistance.