The employment market report from Australia is a volatile set of data - due at 0030 GMT

I posed a preview here yesterday:

This report has been indicating solid jobs growth and (median consensus) expectations are for more today:

Employment Change:

- expected 15.0K, prior 34.7K

Unemployment Rate:

- expected 5.5%, prior 5.5%

Full Time Employment Change,

- prior was +15.1K

Part Time Employment Change,

- prior was +19.5K

Participation Rate,

- expected is 65.6%, prior 65.7%

Downside surprises should weigh on the currency ... to the extent that anything will take the focus of the USD though. On the other hand, in line or higher and the Australian dollar should continue to find support.

More previews (bold mine) now, via:

Westpac:

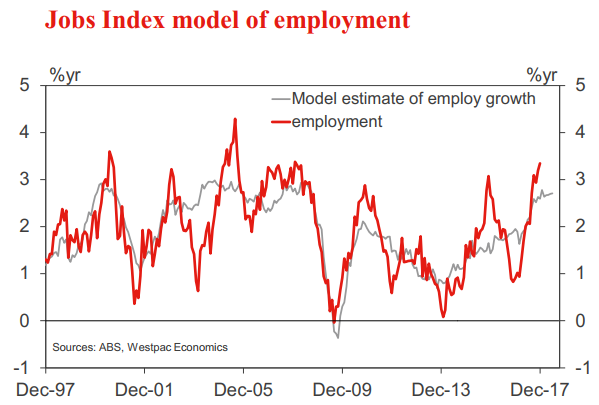

December sealed a solid year for the labour market. ... In the year total employment gained 403k or 3.3%.

- In the year, full-time employment gained 303.4k

- Part-time employment up 99.7k/2.61%yr

- Total hours worked up a solid 3.2 %yr

For the December month ...

- the 15th consecutive monthly gain in employment matching the longest period of consecutive employment which ended July 1994

Will we see a 16th consecutive gain in January?

Statistical volatility may prevent it but with our leading indicators remaining very robust there is little to point to a negative print this month.

More:

In the month unemployment rose to 5.5% (5.55% at two decimal places vs. 5.41% in November) with a 0.2ppt gain in participation driving a further 55.16k surge in the labour force. This surge in participation has been driven mostly by the incredible jump in females to a new high of 60.6%. Female employment lifted on the back of strong growth in the services sectors. Of the top five sectors for employment in 2017, four have a higher than average share of female employees. And this robust demand for labour has drawn more females into the workforce and/or encouraged others to extend their working life. That is as demand for female labour has risen, so too has supply. We do see a small pullback in participation, from 65.7% to 65.6%, which moderates the January gain in the labour force. Thus the +15k on employment will see the unemployment rate hold flat at 5.5%.

CBA:

- Jobs growth of 400k over the past year, or 3.3%, is extraordinarily strong. Leading indicators point to more solid jobs growth over the next few quarters.

- Rising part rate tends to limit the fall in the unemployment rate.

Barclays:

- We expect the labour force participation rate to moderate somewhat, but forecast continued employment gains which should mean the unemployment rate falls at the margin.

---