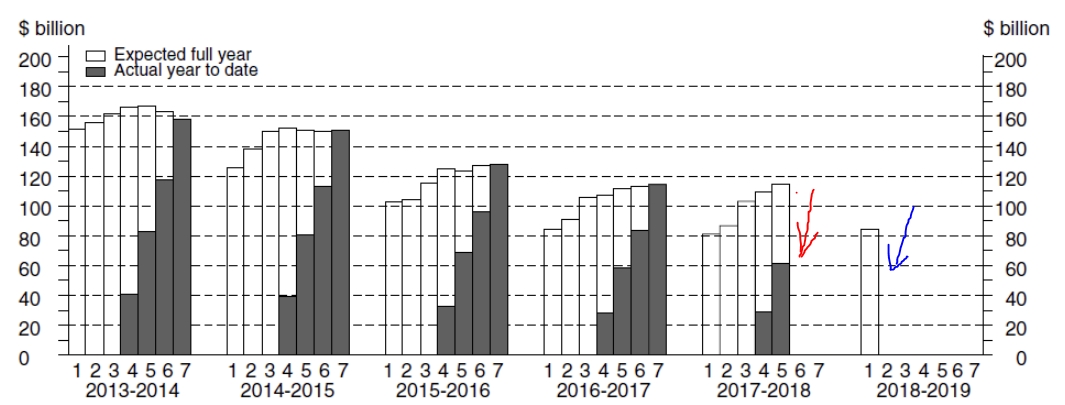

Data for Private Capital Expenditure for the October - December quarter, Australia.

For Q4, the headline is in at -0.2% for a miss

- expected +1.0%

- prior +1.9%, revised higher from +1.0%

- 5th estimate for 2017/18 in at AUD 114bn

- First estimate for 2018/19 is AUD 84bn, slightly under the Reuters expected at 86bn

- 5th estimate for 2017/18 is the red arrow (slightly above the 5th estimate for 2016/17)

- 1st estimate for 2018/19 is the blue arrow (slightly above the 1st estimate for 2017/18)

The headline 0.2% drop is a poor result and will subtract from Q4 GDP (due March 7)

- The revision to Q3 GDP (much higher, nearly double what had previously been reported) is softening the blow somewhat

... the 'estimates' of focus are a slight improvement but still pretty dour.

You can see from the entire graph the decline in capital expenditure, associated with the unwind in the mining investment boom; there is some increase in capex into other sectors of the economy, but these are not approaching the levels seen during the mining infrastructure boom times.

AUD/USD dribbling a little lower still, under 0.7750 as I update

More:

- spending on equipment, plant and machinery +2.2% (will add to GDP data, for release next week)