Coming up on Tuesday, consumer inflation data from the US

- Due at 1230 GMT Tuesday 13 March

This will be a market focus, if its continues edging higher it'll perhaps prompt a faster pace of Fed rate hikes, and if not ... yikes, a dialling back of expectations for hikes could give the EUR another leg (for example).

A couple of quick previews ... (bolding mine)

RBC:

- Following very firm reads in both headline and core prices in the last go-around, we expect a much more modest outcome this month.

- Indeed, we anticipate 0.1% gains in both metrics, which leaves core prices just shy of the 2% mark.

- Gasoline will play no role this month, as the modest advance was just shy of the anticipated seasonal change. Ultimately, this should calm fears of an imminent inflationary problem. To be sure, we expect both headline and core inflation to overshoot 2% by a significant margin early in H2, but largely owing to easy year-ago comps.

UBS

- Consensus expects headline and core CPI to print at 0.2% m/m in Feb (prev. 0.5% and 0.3%, respectively), consistent with our economists' view that continued labour market tightening will support higher shelter prices.

Capital Economics

- Following an outsized 0.3% m/m increase in January, our calculations suggest that core consumer prices increased by a more modest 0.2% m/m in February. That would be enough to push the annual core CPI inflation rate up only marginally to 1.9%. But we already know that it will then jump back above 2% in March, as the sharp slump in wireless telephone services prices in March 2017 falls out of the calculation.

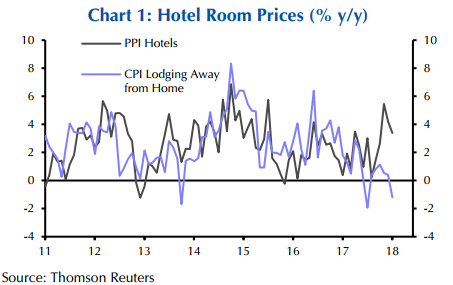

- The big January gain was principally due to large increases in clothing and hospital services prices. Those won't be repeated, but we also don't anticipate a reversal in February. In contrast, the 2.0% m/m drop in the notoriously volatile lodging away from home component probably will be reversed.

- Otherwise, the drop back in gasoline and natural gas prices point to energy prices being a small drag. As a result, we anticipate a more modest 0.1% m/m increase in headline CPI, leaving the annual inflation rate unchanged at 2.1%