Equities had their worst week in over 2 years, and the recent bond rout was one of the major reasons for that

Almost every investor in the market today is concerned if the rout in equities from last week will run deeper, and so far in Asian trading and at the start of European trading, it's done little to ease their worries.

Concerns started to come about last week when the bond market was going down, which sparked a rise in yields - at the time UST 10-year yields were only 2.70% when I wrote this.

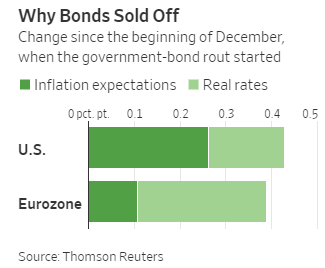

The global rout in bond markets are largely different, but they are derived from the same underlying factor. In the US, the market is anticipating higher inflation. In Europe meanwhile, the market is anticipating a rise in real rates.

In the US, market participants turn towards TIPS (Treasury-inflation protected securities) instead of your average bonds as a hedge against inflation - whereas in Europe, market participants aren't really looking towards inflation-linked securities.

In fact, you can just check out the yield curves in the US and Europe to see that difference. US yield curve remains flat, but Germany's yield curve is actually steepening to its steepest shape since mid-2014.

But either way, it is because of the anticipation of inflation that is giving rise to yields. Inflation expectations are what is driving central banks' decisions, and in turn is what drives rates - so talk about global growth and inflation rising is starting to drive up real rates/yields and that is coming to haunt equity investors.

As yields rise, there is more comparison being done to which provides a better return: equities vs fixed income. And Bloomberg's chart here highlights that issue very well:

It just makes more sense for investors to lean more towards bonds when they offer more of a reward for much lower the risk associated. That is causing some fund reallocation, which in turn is why we're seeing money out of equities.

I always like to think of the Occam's razor psychology when it comes to markets, and it's the same as trading as well, keep it simple. Don't over-complicate things.

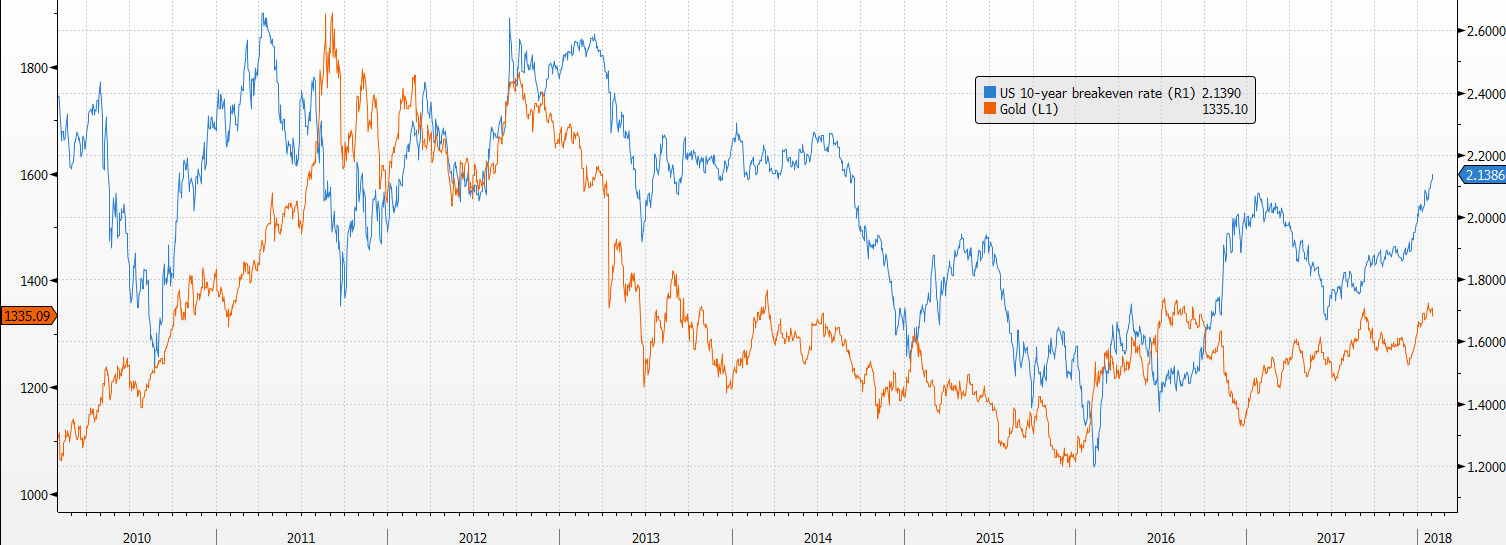

And in the midst of all this chaos, going by the fact that the market is starting to fall in love with inflation trades again, gold could be the standout performer this year if that's the case.

It's not always a perfect correlation, but gold does tend to move with inflation expectations most of the time. A good gauge of that is the US 10-year breakeven rate and here's how gold has been performing relative to it in the past: