The first look at second quarter Canadian growth

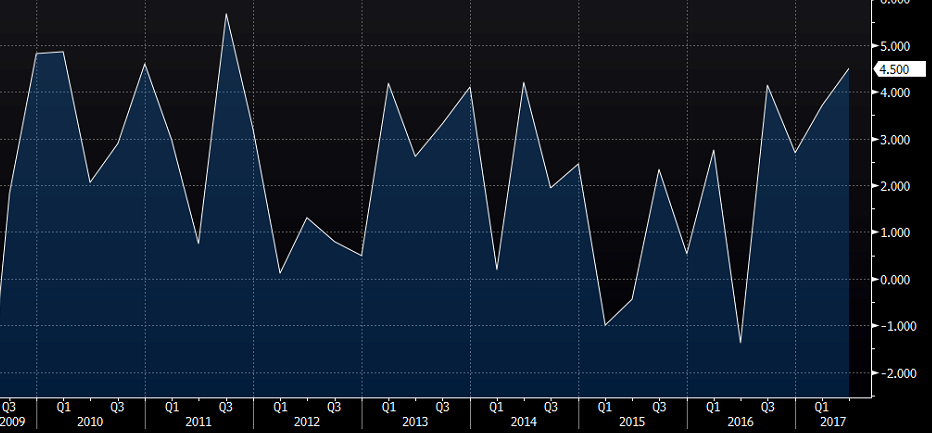

- Best quarter since 2011

- Q1 was +3.7%

- Q4 2016 was +2.7%

- Economists estimates ranged from +2.4% to +4.0%

- Year-over-year GDP 4.3%

- Prior 4.6% y/y (revised to 4.7%)

- The past two y/y numbers were the best two since 2001

- June GDP +0.3% m/m vs +0.1% exp

- May GDP +0.6% (unrevised)

Fantastic reading, very big beat. Canadian dollar higher, sending USD/CAD down to 1.2587 from 1.2650.

Details:

- Household consumption +4.6%

- Government consumption +2.5%

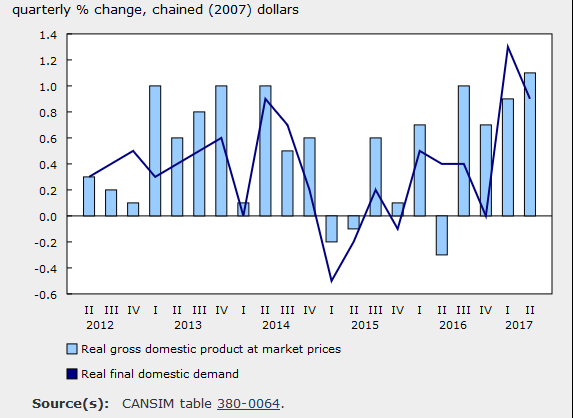

- Final domestic demand +0.9% q/q

The final domestic demand number was one we highlighted before the release and it was very strong, which is a good sign for Q3.

More details:

- Outlays in goods +1.9% -- strongest since Q2 2007

- Durable goods +2.3%

- Investment in residential structures -1.2%

- Exports +2.3%

- Export volumes of crude +7.4%

- Imports +1.8%

- Business investment in non-residential structures +2.4%

- Business inventories +$11.5B vs +$10.5B prior

- Business investment added 0.1 pp to q/q growth

- Inventories up 7.1% in Q2 and 13.7% (annualized) in Q1

- Corporate earnings -0.1%

There are a few concerning numbers here. Inventories added to GDP and that spike in crude volumes is not sustainable but they are small negatives in a great report. The real story here is that Canadian consumers are on a tear and even with more spending, the savings rate rose, so it was a story of higher incomes.