Just how bad have forecasts been?

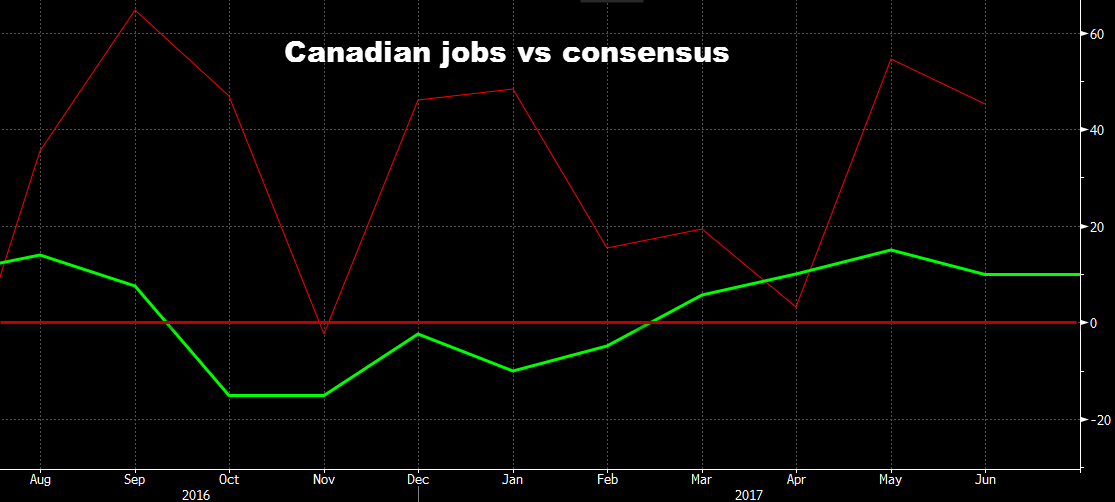

For Friday's Canadian jobs report, the consensus estimate of economists is for 10,000 new jobs. If that sounds familiar, it's because that's exactly what they forecast a month ago. A month earlier, 15,000; the month before that 10,000.

At this point, they're not even trying.

The forecasting has been so bad, for so long that they just pen in 10K to the most important data point of the month, and head for coffee at Tim Horton's.

After such terrible forecasting for so long, they should be bringing a job application with them.

Since the start of 2015, Canadian economists have forecast a net 87,950 jobs. There have been 494,450 jobs added. The average forecast has been about +3K; the average result +16.5.

Since last August, it's been particularly bad. The average forecast has been +1.3 and the average gain 33.9K. In there was a five-month stretch where they forecast declines every month and the average gain was 40K with the lowest month at +12.6K. It was a lesson on the stupidity of sticking with a forecast and hoping for mean regression.

In that sense, pencilling +10K and hoping for the best is an improvement.

Ok, rant over. There's is a real takeaway here. It's that Canadian economists are extremely stubborn and prone to groupthink. The big banks all toe the same line.

There is no better example than the recent Bank of Canada saga. In June, Wilkins dropped a hawkish bomb and they pretended like hardly anything happened. The hints kept coming and they did things like moving Q3 2018 rate hike forecasts up to Q2 2018.

Even those who conceded that a hike was coming in July said it would be one-and-done and USD/CAD would bounce.

The lesson is not to trust what Canadian economists are saying. Whether they're talking about housing or the economy, they just don't seem to have a grasp on what's happening. Listen to the BOC and go with the headlines.

...now watch Friday's report come in right at +10K.