Forex futures net speculative positions as of the close of business on Tuesday July 18, 2017

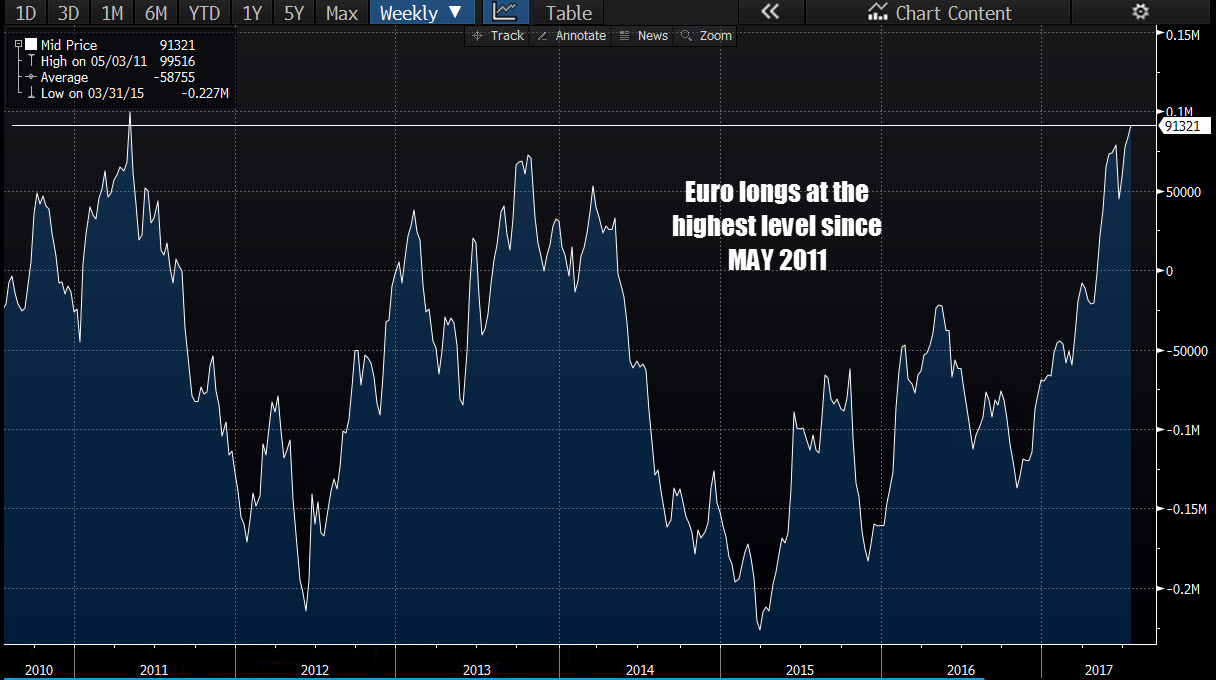

- EUR long 91K vs 84K long last week. Longs increased by 7K

- GBP short 16K vs 24K short last week. Shorts trimmed by 8K.

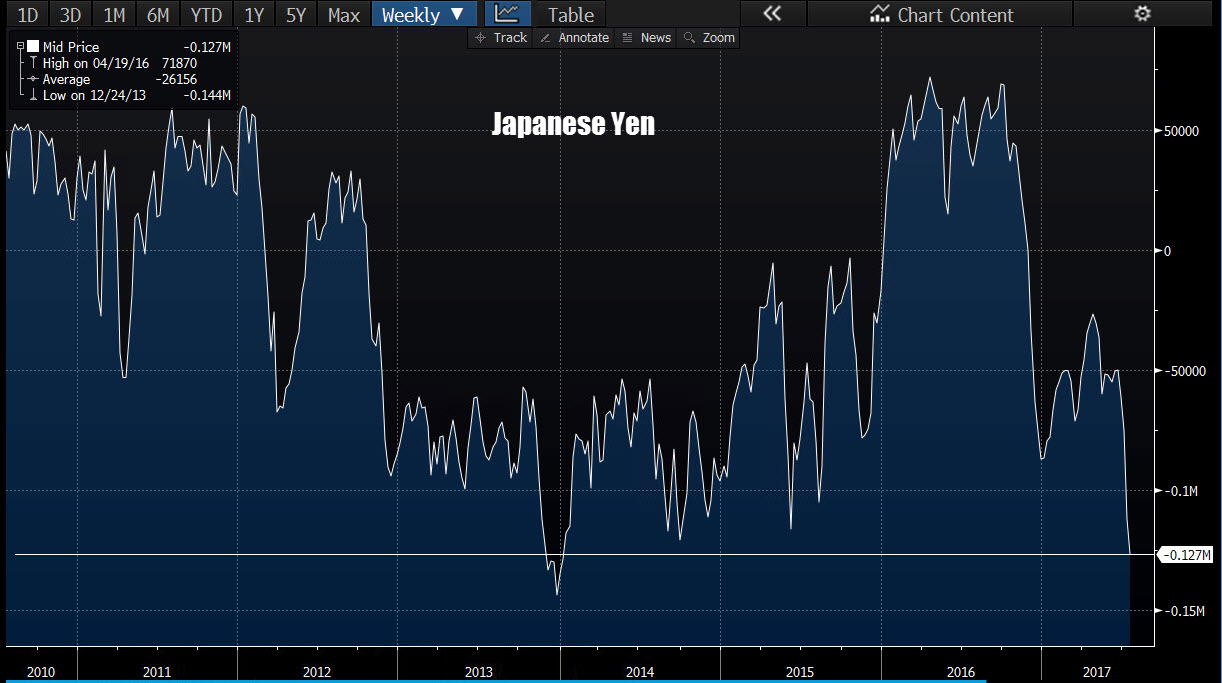

- JPY short 127K vs 112K short last week. Shorts increased by 15K

- CHF short 4K vs 0K short last week. Shorts increased by 4K

- CAD long 8K vs 9K short. CAD position shifts by 17K new longs. Position is now long.

- AUD long 51k vs 37k last week. Longs increased by 14K.

- NZD long 36K vs 32K long last week. Longs increased by 4K

Highlights:

- The JPY short increased by another 15K in the current week. The short position is at the largest level since January 2014. The USDJPY traded at the lowest level since June 2017 (higher JPY). Traders continue to lose and add to their positions in the process.

- The EUR longs are the largest since May 2011. Unlike the JPY, as the positions have increased in the EUR, so has the value of the EUR. As a result, the traders are making money in that currency.

- The CAD moved close to square last week and this week turned from short to long. The CAD had record shorts not too long ago, and traders took it on the chin as the currency moved higher and higher. The BOC raised rates last week for the first time in 10 years. This week, the net speculative position turned positive (finally). Better late then never (as long as the currency continues to go higher). Today, the CAD is trading at the highest levels since May 2016 (USDCAD lower). As a result, the longs in the CAD are making some of their money back (for now at least).

- AUD longs (+51.3K) moved higher and is near the longest level going back to 2013 (the largest long in 2016 was at 59.6K).