Risk assets are universally weaker today but Dr. Copper is lagging, down 2.25% to 3.41/lb.

The Canadian dollar has a strong correlation to copper because they’re both proxies for global growth. Looking at a copper vs USD/CAD (inverted), we see that the commodity tends to lead the currency:

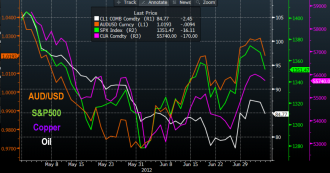

Another chart we have been following plots AUD against oil, copper and the S&P 500 since the slump at the beginning of May.

The Australian dollar has outperformed even the resilient US stock market. Oil, meanwhile, has disconnected… or is it best capturing the slowdown in global growth? If AUD were to catch up to oil or copper, it would have to fall to parity or lower.