Trying to get to the bottom of the XIV implosion

I've been reading the prospectus of the XIV ETF. It's imploded in after hours trading to $18.72 from $99 at the close.

There are all kinds of rumours about liquidation and panic. To me, it shouldn't be in liquidation. The prospectus says the underlying instruments need to fall 80% to cause a closure but the Feb and March VIX futures it's based on fell about 50%. The exact terminology is "if the Intraday Indicative Value is equal to or less than 20% of the prior day's Closing Indicative Value."

Or maybe I'm missing something.

However one thing I'm not missing is this line:

"The Intraday Indicative Value and Closing Indicative Value for each series of ETNs will be published on each Index Business Day under the applicable Indicative Value ticker for such series of ETNs, as set forth on the cover of this pricing supplement," the prospectus says.

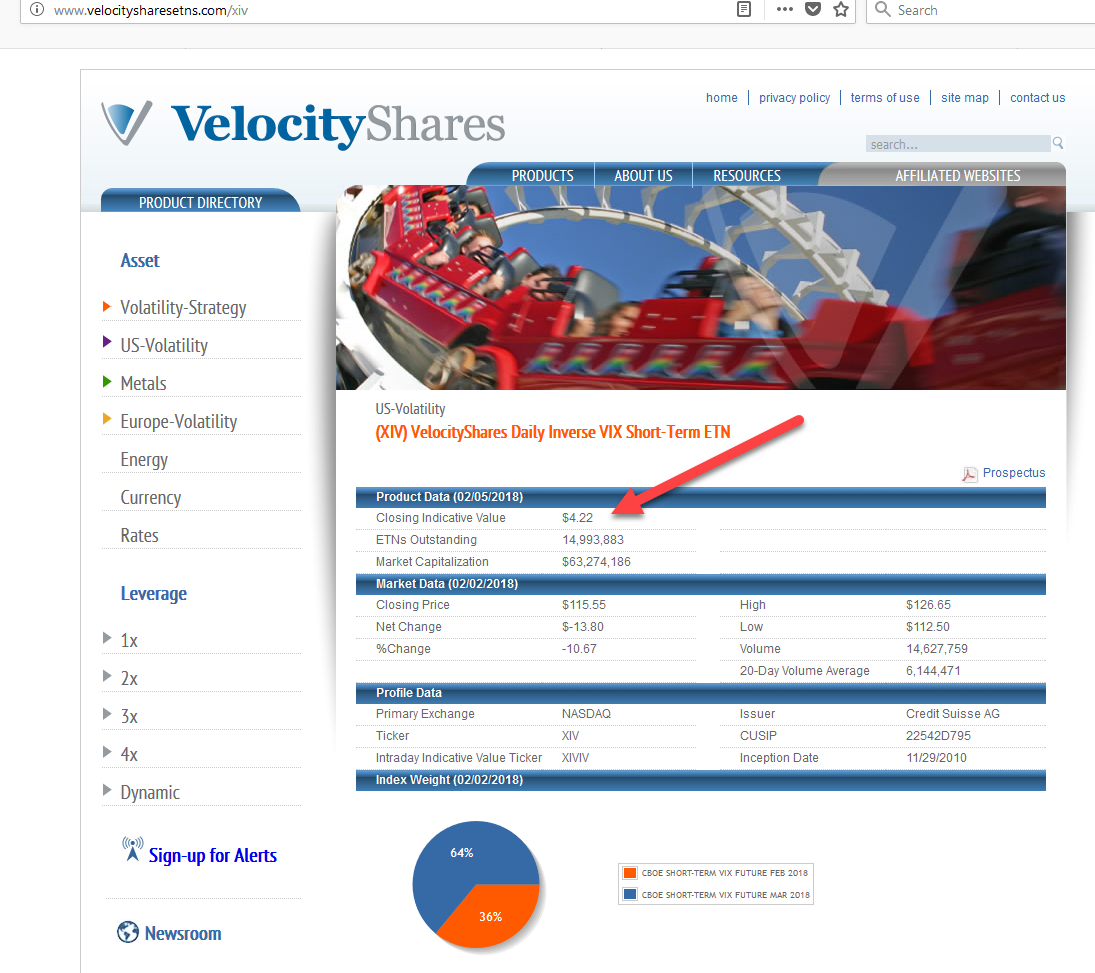

Today's Closing Indicative Value was just published on the ETF's webpage and it's just $4.22.

For more on the XIV implosion: