What's coming up on the economic calendar front today

Good day, everyone! Hope your week is going well. Earlier in the day, we had Democrat Doug Jones win the Alabama Senate race - which caused the USD to fall across the board. That's the big news so far coming into the European session.

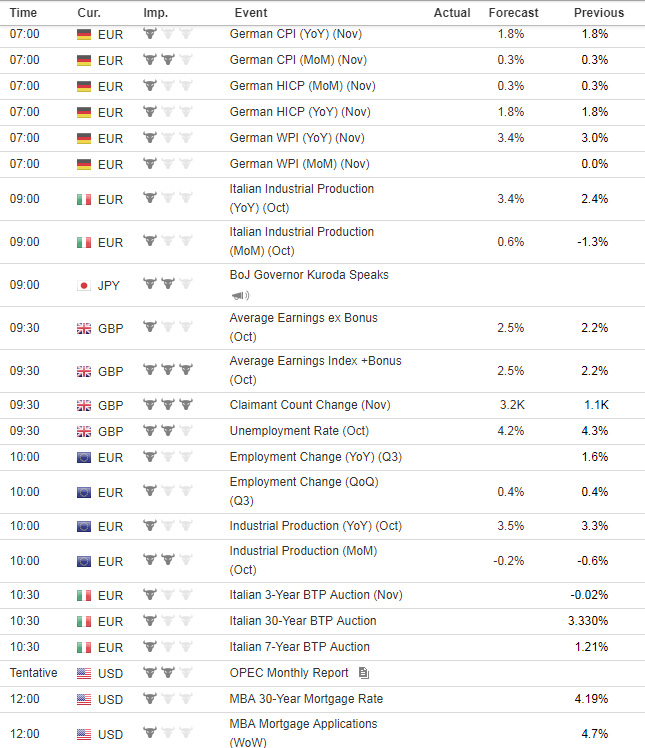

Anyway, here's what's on the calendar for today:

0700 GMT - Germany November CPI final reading

- CPI y/y +1.8% expected*

- CPI m/m +0.3% expected*

This is of course the final numbers, of which the preliminary* reading was already released at the end of last month. Shouldn't have too much of an impact considering that the market already had a glimpse of what the numbers should be. An inflation sentiment indicator for the Eurozone if anything else.

0900 GMT - Italy October industrial production

Another minor Eurozone data point - one which highlights production improvements in the business cycle. It will just serve as another sentiment indicator to the Eurozone more than anything else.

0900 GMT - BOJ Kuroda gives a speech at a year-end gathering with economists

May not have much about monetary policy, but we'll see.

0930 GMT - UK November employment report

- Claimaint count change +3.2k expected

- Average weekly earnings 3m/y +2.5% expected

- Average weekly earnings (ex-bonus) 3m/y +2.2% expected

- Unemployment rate 4.2% expected

A good follow up to yesterday's CPI numbers. This will be a good measure as to how much wages are growing relative to the increasing CPI and PPI numbers in the UK.

1000 GMT - Eurozone Q3 employment change and October industrial production

Similar to the above, it's just another general sentiment indicator of the Eurozone economy more than anything else. Not a headline mover, surely.

That's all for the day. Tomorrow, we'll have central bank bonanza coming up of course - so be prepared. As always, have a good day ahead and good luck with your trading!