What's coming up on the calendar front today

Howdy, everyone! Japanese markets are back in the picture today, and what a start it is for the Nikkei. It's currently up by 2.82% in the final hour of trading. That's helping to keep USD/JPY a little buoyed as well on the day.

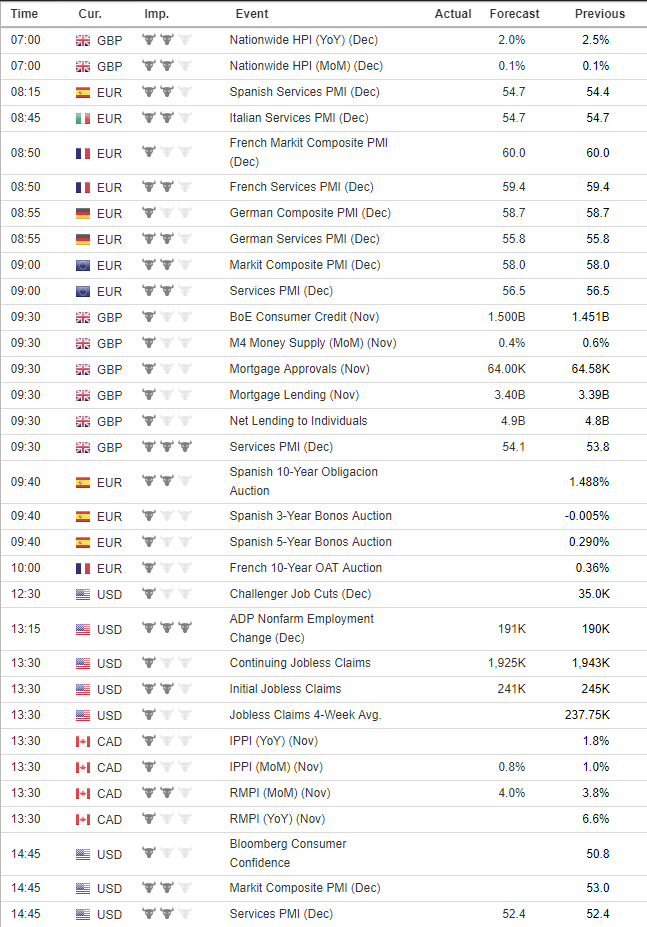

Anyway, here is what's coming up on the calendar front in European trading:

0700 GMT - UK Nationwide Dec house price index (HPI) m/m & y/y

Not really the biggest of data points, but gives a glimpse into the UK housing market - and general view on one part of the UK economy.

0815 GMT - Spain Dec services PMI

0845 GMT - Italy Dec services PMI

Relatively minor data points, as the major ones to look out for are the France, Germany, and Eurozone numbers - which I'll elaborate more on below.

0850 GMT - France Dec final services & composite PMI

0855 GMT - Germany Dec final services & composite PMI

0900 GMT - Eurozone Dec final services & composite PMI

The more important ones to look at, but then again these are final readings. So, unless they are totally off key from preliminary readings - nothing too much to glance at really. Preliminary readings can be found here: France, Germany, Eurozone

0930 GMT - UK Dec services & composite PMI

0930 GMT - UK Nov mortgage approvals

0930 GMT - UK Nov M4 money supply m/m & y/y

The key release will be the services PMI as that is the main sector of the UK economy. The sterling has pared gains into the new year yesterday, as Brexit talks are starting to slowly come back into focus - so the reaction here will depend on the Brexit landscape if we're hearing any news later. Otherwise, there should at least be some movement in the data release. Services PMI is expected to come in at 54.0 (Bloomberg estimate), prior reading at 53.8.

1230 - US Dec Challenger job cuts y/y

Monthly data released by Challenger, Gray, & Christmas, Inc. Doesn't really have too much correlation to the labour market, but a data point to look at the number of job cuts announced by employers.

A little more data points than what we had in the last two days, but it's a good way to ease into the year. Hope you all have a nice day ahead, and good luck with your trading!