10 year yield in Europe mixed

The European major stock indices are ending the session with mixed results. Italy recovered after the weekend elections, but most of the other indices gave up some of their gains.

- German DAX rose 0.2% at 12113. The high reached 12259

- France's CAC rose up 0.12% at 5173.35. The high reached 5216.

- UKs FTSE rose 0.44% at 7146. The high reached 7197

- Spain's Ibex fell -0.1% at 9585. The high reached 9677

- Italy's FTSE MIB bucked the trend with a sharp 1.75% gain to 22202. It's high reached 1.916%, -3.7 basis points's FTSE MIB fell -0.3% at 5352. The high reached 5415 before moving back down

In the 10 year debt market, yields were mixed.

- Germany 0.674%, +3.0 basis points

- France 0.96%, +1.9 basis points

- UK 1.52%, +2.4 basis points

- Spain 1.488%, -1.0 basis points

- Italy 1.995%, -0.8 basis points

- Portugal 1.916%, -3.6 basis points

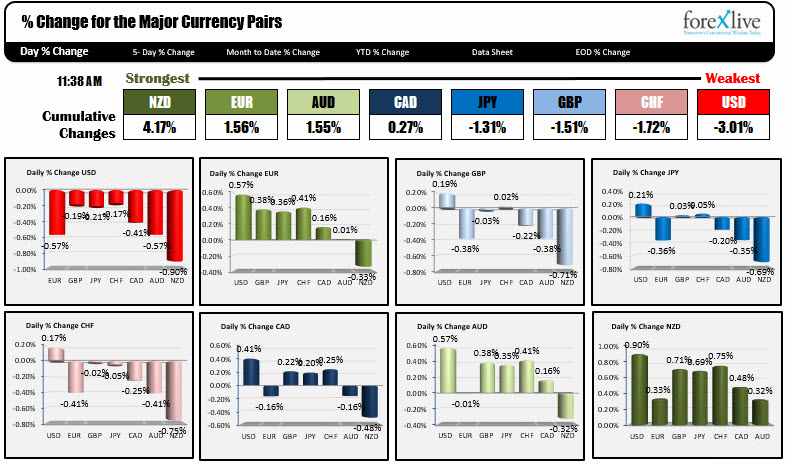

In the forex market as London/European traders look to head for the exits, the NZD is the strongest, while the USD is the weakest. The USD took over the weakest currency slot from the JPY at the start of the NY session. The JPY remains lower vs the NZD, AUD, CAD and EUR, but is unchanged or higher vs. the USD, GBP, and CHF.