February was not great either.

The European stocks took it on the chin today with the German Dax leading the downside tumble with a -2.23% decline. That is on the back of a -5.71% fall in February. Combine the two and Europe's biggest economic powerhouse is down nearly -8%.

A summary today is showing:

- German DAX down -2.23%

- France's CAC down -1.17%

- UK's FTSE down -1%

- Spain's Ibex down -1.2%

- Italy's FTSE MIB down -0.7%

- Portugal's PSI 20 down -1.6%

The fall in stocks is not giving confidence for the 10 year debt sector. Yields are lower again today:

- Germany 0.643%, -1.3 basis points

- France 0.91%, -1.0 basis points

- UK 1.466%, -3.4 basis points

- Spain 1.508%, -3.0 basis points

- Italy 1.947%, -2.7 basis points

- Portugal 1.948%, -4.3 basis points

In other markets as the London/European traders look to exit:

- Spot gold $-7.50 or -0.57% at $1310.80

- WTI crude oil futures down $.40 or -0.63% at $61.25

US stocks are hanging above and below the unchanged levels today

- S&P index +4 points or 0.15% at 2717.88

- NASDAQ composite index +10.4 points or 0.15% at 7284

- Dow industrial average up 30 points or 0.13% at 25061

US yields are near unchanged levels after being a bit lower earlier in the session

- 2 year 2.252%, unchanged

- 5 year 2.628%, -1.1 basis points

- 10 year 2.855%, unchanged

- 30 year 3.13%, +0.5 basis points

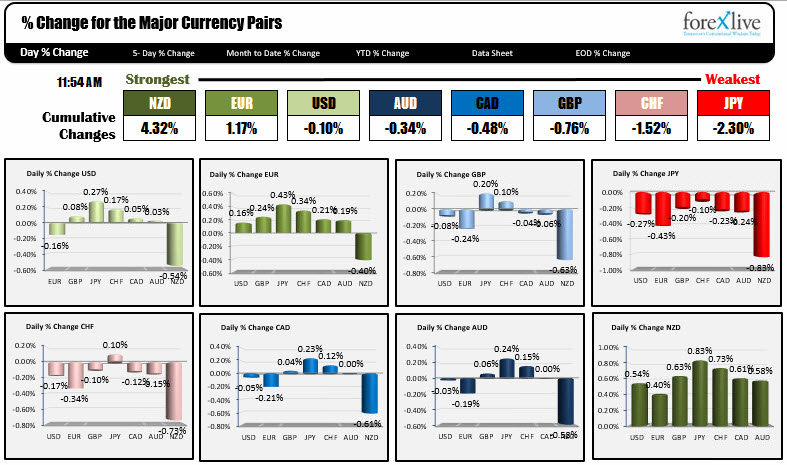

The NZD is the strongest. the JPY is the weakest. The USD is mixed at NY midday.