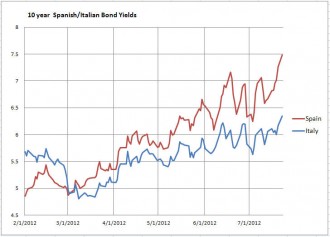

Spanish debt reached a high of 7.565% today (current yield at 7.484%). The high on Friday extended to 7.284% (closing at 7.267%). Debt problems from six Spanish regions has traders concerned that a bailout of the country may be needed as debt costs are too high. Yields on safe havens like Germany, US and UK are all down. Gold is down. Oil is down. The S&P is down -15 and the Dow Jones is down -150. European bourses are all in the negative.

The EURUSD gapped to new 2012 lows but in the 1st minutes of NY trading moved to new day highs at the 1.21375. The low from Friday came in at 1.21436. The price has moved back lower and currently is back below the 1.2131 level which is the 50% of the range since the Euros introduction. This level will be eyed for bias clues.

The last time the market was this low was over a 5-6 day period from June 4th-11th, 2010 (see hourly chart below from that period). Support areas/levels from the time period include:

- Highs and low region in the 1.2072-785 area (see yellow area in the chart below). The low today at 1.20811 found support against this area.

- The low from June 11 at 1.2045.

- The high from June 8 at 1.2008

- An area between 1.1972-1.1991. 1.1972 is trendline support from the monthy chart above (connecting the November 2005 low at 1.1635 to the June 2010 low at 1.1876).

- 1.1912 which is a low area from the 7th and 8th

- The low from June 7th at 1.1876.

These are the steps that I will be looking at to confirm continued weakness in the pair.

Remember the EURUSD is coming off of a two week period where the range was narrow from historical standards (189 pips over 2 weeks). This suggests that there could/should be something larger going forward. The move down on Friday and gap lower today has gotten the ball rolling to the downside. The high from Thursday to the low today has spanned 241 pips which is a step toward that move. I would expect that traders will be eyeing the gap above (to 1.2144) ane the low from June 13 at 1.2162 to hold corrections and keep the trend moving to the downside.

Remember, trends tend to be fast, directional and have larger trading ranges.