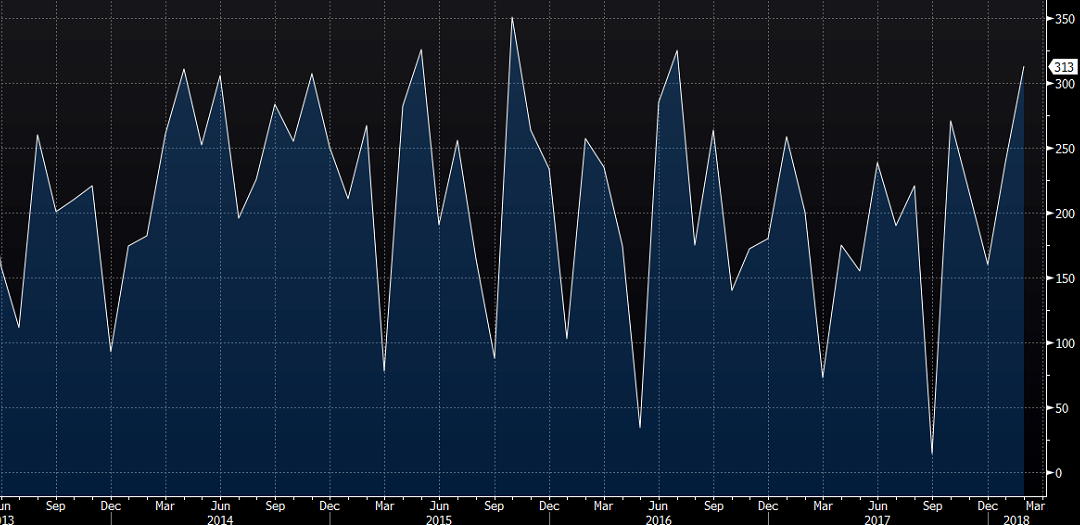

Highlights of the February 2018 non-farm payrolls report

- Highest since July 2016

- Prior was 200K (revised to 239K)

- Unemployment rate 4.1% vs +4.0% expected

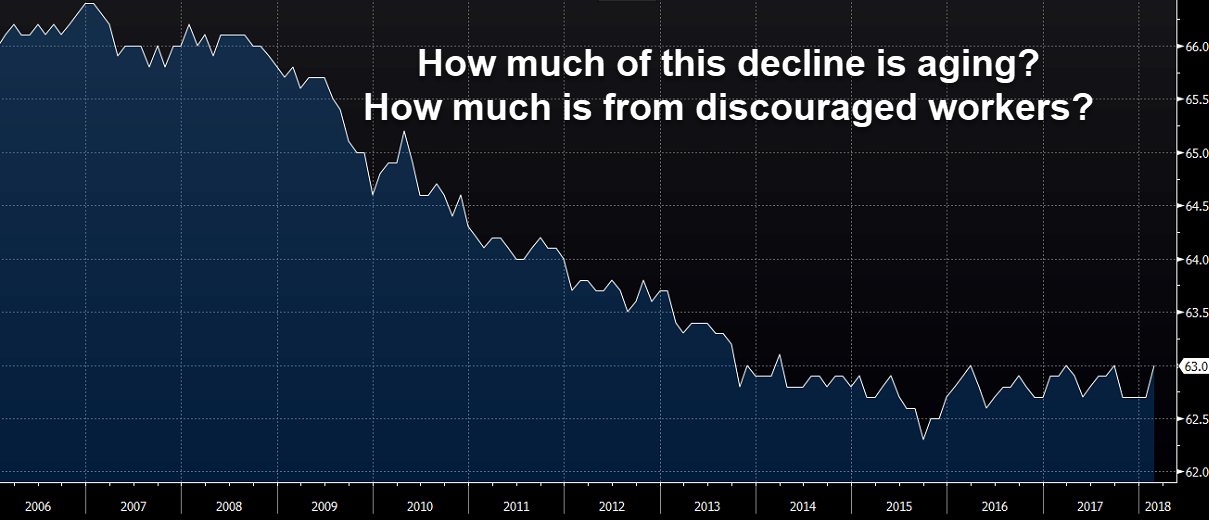

- Participation rate 63.0% vs 62.7% expected

- Underemployment rate 8.2% vs 8.2% prior

- Two month net revision +54K

- Private payrolls 287K vs 205K expected

- Prior private payrolls revised to 238K from 196K

Wages:

- Average hourly earnings 2.6% y/y vs 2.8% exp

- Average hourly earnings 0.1% m/m vs +0.2% m/m exp

- Prior avg hourly earnings revised to 2.8% from 2.9%

- Prior avg hourly earnings unrevised at 0.3%

- Hours worked 34.5 compared to 34.4 expected

- Prior hours worked revised to 34.4 vs 34.3 prior

This is one of the goldilocks reports for equities with strong jobs growth and soft inflation. Inflation, however, is the sole focus of the FX market and that's meant US dollar selling. It's less pronounced against the yen because stock futures are rallying and that's pushing up risk appetite. Something like AUD/JPY could end up being the winner in all this.

Taking a closer look at wages data, it looks like a jump in wages in healthcare last month reversed but in general, the slight softness was broad based.

Another big takeaway is the jump in the participation rate. The Fed will see that as a sign there was more slack in the labor market than they had thought. It might argue for allowing the economy to run hot for a bit longer to see if more people can be pulled back into the labor force.