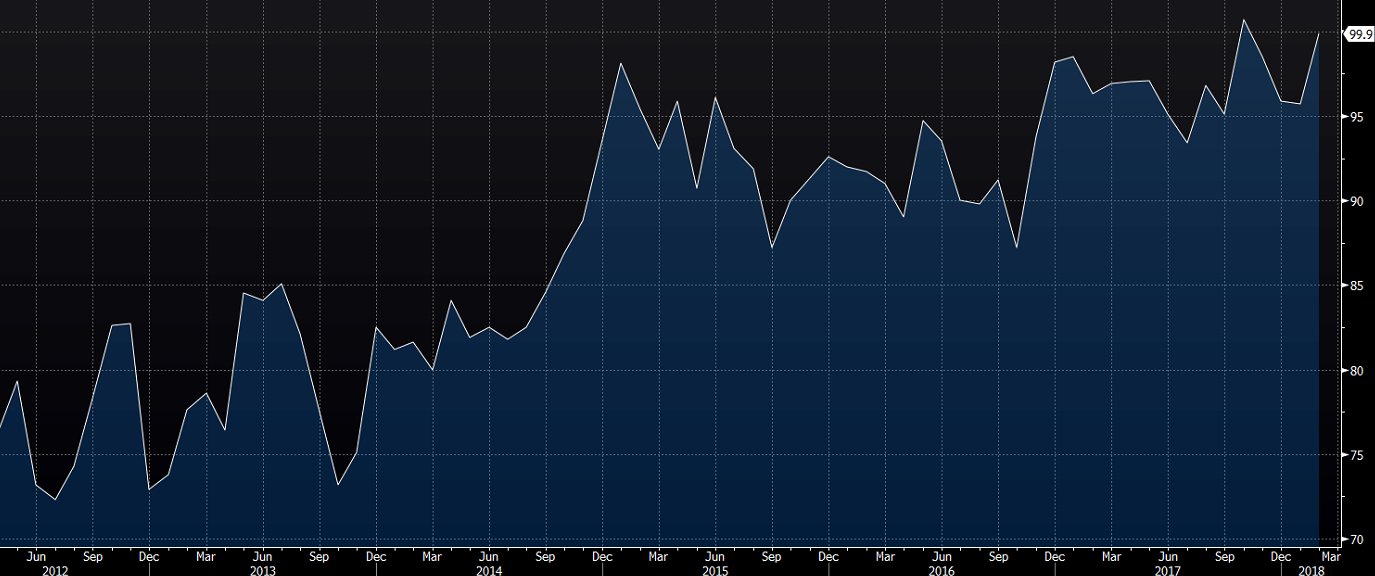

The first look at consumer sentiment from the University of Michigan

- Highest since October, second-best reading since 2004

- Prior was 95.7

Great headline and the details are solid:

- current conditions 115.1 versus 111.1 prior

- expectations 90.2 versus 87.2 prior

- one-year inflation 2.7% versus 2.7% prior

- 5 - 10 year inflation 2.5% versus 2.5% prior

Great report. The headline was better than any economist in forecast survey. It helps to confirm strong hiring and optimism about tax cuts. It's a surprise that the dip in stocks didn't hit a bit harder.

"When asked to identify any recent economic news they had heard, negative references to stock prices were spontaneously cited by just 6% of all consumers. In contrast, favorable references to government policies were cited by 35%," the report said.

I find that shocking that when asked about negative economic news this month, only 6% of people noted the stock market. I mean, what else was there? Even worse 7% cited the stock market as good news.