Forex and cryptocurrency news from the European morning trading 13 Mar 2018

News:

- ECB's Lane says that there is no concern about current euro level

- EU's Juncker says that Trump's metal tariffs are a 'lose-lose' policy

- EU's Dombrovskis says that EU is prepared to react to US tariffs

- Barnier says all EU rules will apply in Brexit transitional period

- EU's Juncker says UK is to regret Brexit decision

- ECB's Coeure says that cryptocurrencies are poor imitations of money

- Japan says G20 meeting likely to discuss recent cryptocurrency and fx moves

- Japan to urge G20 nations to step up their game against money laundering using cryptocurrencies

- Japan's finance minister Aso likely to skip G20 meeting next week - Reuters

- Japan's Asakawa says that they are aiming for Aso to go to the G20 meeting

- OECD forecasts 2018 global growth of 3.9%

- France's Le Maire says that jobs boost show increased confidence in the country

- US inflation data in focus, but it's not going to change the Fed's thinking

- Heads up on the UK Spring Statement due later in the day

- Cable's upside is still capped by early March highs

- FX option expiries for the 14.00 GMT cut - 13 March 2018

- The yen extends its decline on the day

- RBA releases latest key economic indicators snapshot

- USD/JPY takes another crack at 107.00 again

- EUR/JPY also knocking on the door of a figure level

- AMP sees the yen weakening from here, eyes USD/JPY at 112

- Kiwi leads the way as European trading set to get under way

- Germany's DIHK say companies face unprecedented labour shortages

- Gold to rise in the second half of the year - TD Securities

- Nordea sees risks tilted towards a lower EUR/CHF as SNB approaches

- Credit Suisse says that they continue to favour CHF and JPY

- Trading ideas for the European session 13 March

- Nikkei 225 closes higher by 0.66% at 21,968.10

- ForexLive Asia FX news: NZD, AUD sneak a little higher

Data:

- France Q4 non-farm payrolls +0.3% vs +0.2% q/q prelim

- Spain February final CPI m/m +0.1% vs +0.1% prelim

- Italy Q4 unemployment rate 11.0% vs 11.0% expected

- US February NFIB small business optimism index 107.6 vs 106.9 prior

- Japan January tertiary industry index m/m -0.6% vs -0.3% expected

All things relative in these times of tight ranges and limited price action but we seen some JPY selling today as USDJPY finds dip demand again. Bitcoin failed into $9500 and since tested $9000

Option expiry interest at 107.00 which has previously helped to cap rallies is absent today but returns tomorrow with $3.6bln worth of contracts rolling off. While the cat's away then, and with diminishing year-end yen repatriation, we've seen the pair pop to 107.23 with yen pairs similarly underpinned and rallying. Expiries at 107.50 today though and should help to contain.

The yen supply given support to core pairs and GBPUSD traded mainly around 1.3895 after failing into 1.3920 with the UK fin min's Spring Statement coming up at 12.30 GMT. EURUSD spiked to 1.2351 from 1.2335 on comments from ECB's Lane but was short lived ands soon back to from whence it came.

USDCHF has trawled around 0.9470 and EURCHF 1.1685 after holding some support lines I highlighted yesterday and pointing the finger at the SNB.

USDCAD held 1.2840 and nudged up to 1.2865 while AUDUSD failed into 0.7900 in Asia and traded tightly around 0.7865 since

Gold has dropped from $1322 to $1318 while oil has also dipped with WTI down to $61.35 from $61.60.

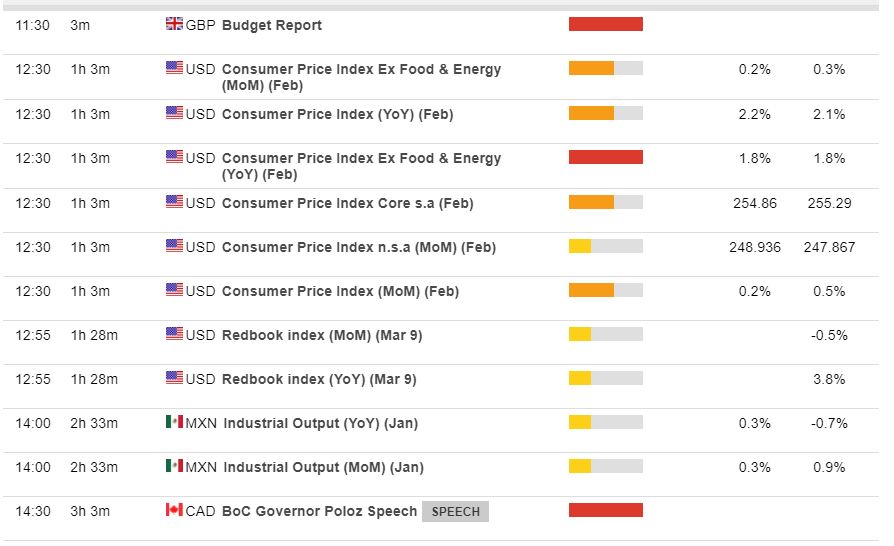

Data focus comes in the shape of US CPI at 12.30 GMT (don't forget NA clocks moved fwd one hour at the week-end)