Forex news for New York trading on November 6, 2017

- US stocks end the session with gains. Another record day for major indices

- RBNZ headlines crossing - fin min announces 2 phase review of mandate

- Fitch: Likelihood of passage of US tax reform proposal into law remains far from certain

- Last hour of stock trading...Disney has talks to buy most of 21st Century Fox

- GBPUSD: Symmetric risks after selloff - Barclays

- SF Fed president Williams: Lays out case for price level targeting

- More Dudley: 2% inflation is not a ceiling

- Fed's Dudley answers audience questions

- Feds Dudley: No comments on monetary policy, nor his early retirement

- Crude oil cracks $57 now. Up to $57.22. Gold up about $9.50 or 0.76%.

- European stocks mostly lower, but most changes are small

- White House highlights three areas of progress from Japan trip

- Canada Ivey PMI 63.8 vs 59.6 last month

- US Commerce Secretary Ross. Pres. Trump places great deal of emphasis on UK bilateral trade

- Reminder: North American turned back the clocks on the weekend

- Betting against bonds swallows another trade

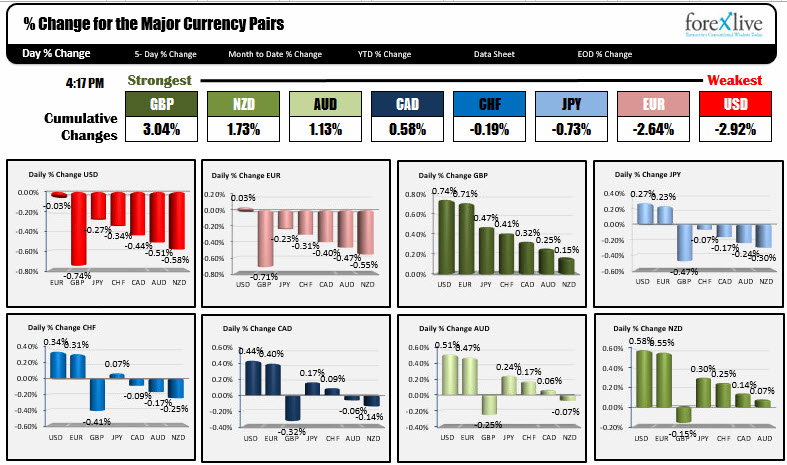

- The AUD is the strongest and the EUR is the weakest as the week starts for NA

- ForexLive morning news wrap: Steady start to the week but euro weakness noted

A snapshot of other markets knew the end of the Trading day shows:

- Spot gold up $12 or 0.95% at $1281.76

- WTI crude oil also rose sharply. Up $1.61 or 2.89% at $57.25.

- US stocks were higher and closed at record levels. S&P index up 3.29 points or 0.13%. NASDAQ up 22 points or 0.33%. Dow industrial average up 9.23 points or 0.04%

- US yields mostly lower with the yield curve flattening. 2-year 1.616%, unchanged. 5-year 1.983%, -0.6 basis points. 10 year 2.316%, -1.6 basis points.. 30 year 2.796%, -1.6 basis points.

The US dollar is ended the session as the weakest currency of the major currencies. The GBP is the strongest.

Contributors to the USDs strength include:

- Lower rates and a flatter yield curve,

- a sharp move higher in gold and oil,

- perhaps some comments from Fed's Dudley and Williams about letting inflation pick up more steam (i.e. get above the 2% target) and

- some technical breaks helped to push the greenback lower.

There were no US economic releases today.

Canada released the Ivey purchasing managers index which climbed to the highest level for the year and highest level going back to early 2016.

President Trump is in Japan working on the art of the deal in order to lower the US deficit with Japan, bring more Japanese businesses to the United States, and to work on a strategy for North Korea. I am sure each of those things are related somehow in the discussions and the deal making.

The oil move was impressive. The weekend news out of Saudi Arabia seemed to bring out even more bulls. The futures are now trading in a $56-61 trading bracket on the break.

Some things to eye in the new day:

In Australia, they are expected to keep rates unchanged after their meeting. Technically, the AUDUSD has traded above and below the 200 day MA at 0.7697 over the last 8-9 days. Most of the action has been below the MA. The price currently trades just below the level at 0.7690. A move above (and stay above) would be more bullish with 0.7729-31 a key level to get above (38.2% and high from last week's trading). On the downside, the close level to get below is the 100 and 200 hour MAs at 0.7676 (converged). Get below them and the sellers will look toward 0.7339 and the double bottom from October 27th (hourly) at 0.7624.

The EURUSD is ending the day little changed after getting close to the low from October 27 at 1.1573. The pair is below the 100 hour MA at 1.1613 and the neckline from the Head and Shoulder break from October 26 at 1.1676. Until those levels are broken, the market will be thinking lower. Targets are 1.1478-88 and the 38.2% retracement at 1.1422.

The USDJPY fell below its 100 hour MA today and then its 200 hour MA (at 114.02 and 113.83 respectively). At the 200 hour MA is the 50% retracement level as well. So that level is now key risk into the new trading day. Stay below is bearish. Move above and the sellers like turn back to buyers. On the downside, get below -and stay below - the 61.8% of the move up from the October 31 low at 113.629 and sellers should be feeling better.

The GBPUSD was the biggest mover in trading today (change of 0.74%). The move higher took the price above resistance at 1.3125 and up toward a cluster of MAs (and 50%) between 1.31646 and 1.3186 (the 50% is at 1.3179 of the the move down from last week high). A move above that area will have traders looking toward 1.3251, but I would expect sellers to put up a big fight here. A rotation lower will need to get back below the 1.3125 and 1.3110 level. Be aware.

Good fortune in your trading.