Stephen Miller, who is now an investment consultant for Grant Samuel Funds Management, says "we are going back to the world as we knew it before the crisis"

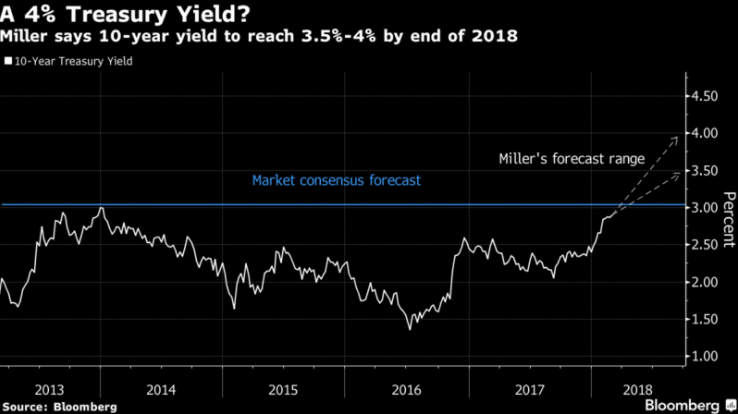

Miller was also the former head of fixed income at BlackRock in Australia, where he spent 14 years at the firm. He says that as markets adjust to an environment with robust corporate profits, the US 10-year Treasury yield will rise to between 3.5% to 4% by the end of 2018.

"As the US economy exits the era of low rates and loose monetary policy, investors need to use a 2% nominal growth and 2% inflation level as their working assumption for investing", Miller argues.

The one thing he doesn't see however, is that such a rise in yields will hurt equities. He does expect cross-asset volatility, but says that with yields ranging between 3.5% to 4%, he "doesn't see that presaging undue difficulty for equity returns".

US 10-year yields have been settling after rising close to 3% recently, now at 2.86%. There are many arguments for the case for it to rise above 3% or cap at 3% in fact. It's a much awaited build up, but as Adam pointed out here, the big question will be what happens next when the "next season is released"?