ANZ on their take on the CFTC data (week ended 27 February 2018, data out on Friday 2nd March)

(in brief)

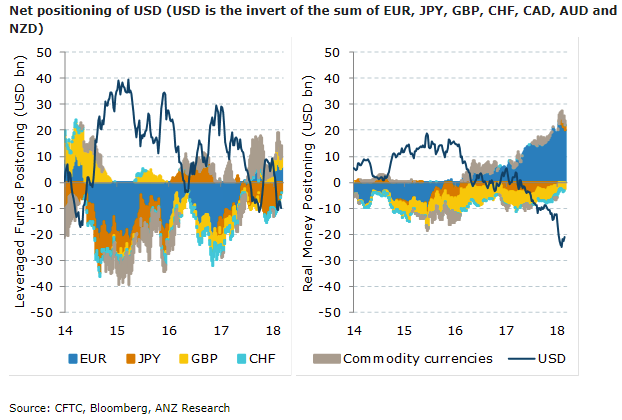

Leveraged funds were net sellers of USD during the week

- Real asset managers turned net buyers of USD

JPY net buying extended into the seventh straight week ... Should there be an escalation of trade tensions stemming from the US tariff decision, JPY could see further safe-haven related demand.

The three week run of EUR net selling by leveraged funds has ended

GBP saw net buying by both leveraged funds and asset managers

- Overall net GBP positioning by both are at the 80th percentile, with leveraged funds long, with asset managers taking a short position

Commodity and EM currencies were sold by leveraged funds

CAD saw the largest net selling ...

- Given that Canada is set to be the most affected by the US import tariffs on steel and aluminium, the next CFTC report is likely to show further net selling of CAD by leveraged funds and asset managers

---

ANZ note:

The CFTC data do not capture the reaction to President Trump's announcement that tariffs on US steel and aluminium imports would be imposed, which sent the USD weaker

---

As I have noted before .....

ANZ look at the US Commodity Futures Trading Commission (CFTC) a little differently to elsewhere:

In a brutally summarised description of how they use it (any errors are mine):

- There are two reports compiled by the CFTC: the Commitment of Traders (COT) and the Traders in Financial Futures (TFF)

- The TFF report provides a richer breakdown of traders into the 'sell side' and 'buy side'

- ANZ use the parts of the TFF report (combined futures and options position of Leveraged Funds) as a proxy for leveraged positioning, where available