From Goldman Sachs Global Investment Research, revisions to their FX views and forecasts

It's a long piece, I've summarised (briefly) for the majors.

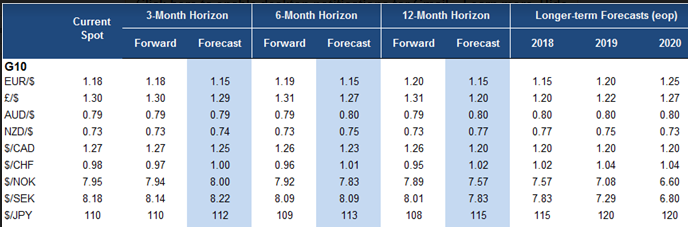

But, if its just numbers you are interested in, they have tabulated (again, in brief):

Exhibit 1: Revised Global FX Forecasts

1. We are revising down our forecast for the US Dollar, primarily against the Euro-moving our 12-month EUR forecast to 1.15 from 1.05 previously-and other European currencies.

- In effect, we are baking in much of the underperformance in USD year-to-date, as we no longer expect its drivers to reverse meaningfully-at least over the near term

- On the domestic front, these include limited progress on pro-growth fiscal policy measures, weaker-than-expected price inflation and wage growth, and a Fed outlook clouded by next year's leadership transition.

- Similarly, at least some of the positive news in other major markets looks likely to persist. In the Euro area in particular, while growth may fade somewhat from boomy levels, the ECB has begun to turn its attention to policy normalization, and the wave of right-wing populism (for the moment at least) appears to be ebbing.

- In many other developed and emerging markets growth has picked up smartly, reducing the degree of US outperformance.

2. But we are not yet ready to call for sustained USD weakness.

- Instead, we see a mixed outlook for the greenback

- three main arguments against extrapolating a continued slide in the Dollar from here

- First, expectations for tax cuts in the US may have become too pessimistic after the failure of the Republican-led Congress to move forward its health care reform proposals. Despite the lack of legislative success to date, we still see better-than-even odds that a tax bill becomes law in 2018.

- Second, even if the Trump administration appoints a relatively dovish Chair for the Federal Reserve, they would still need to navigate the rest of the committee, and will likely face an economy already operating close to full employment.

- Third, the equity capital inflows that have supported EUR appreciation for much of this year may not continue at the same pace-the Euro Stoxx 50 has underperformed the S&P 500 by about 7% since early May, and our asset allocation team recently moved to neutral on the market for their three-month view.

- We therefore expect a range-bound USD into end-2017.

3. We see our revised projections as consistent with the prospect of multiple Fed rate hikes next year.

- broad Dollar could move sideways or even depreciate while the Fed is hiking rates

- (our US economics team continues to forecast four rate hikes next year).

- First, a steep path for the funds rate need not price-in immediately

- Second, rate differentials are not a sufficient statistic for forecasting exchange rates

- Third, Fed rate increases do not always equate with USD strength

- Exchange rates are driven by pressures on an economy's balance of payments, some of which are driven by (or at least correlated with) rate differentials, so the rate outlook and monetary policy are always central to our process. But as recent months demonstrate, other factors like valuation and risk-asset flows are also critical.

4. Investors should look for relative value opportunities in G10 FX.

- we now expect further downside to USD/CAD

- continue to see scope for EUR/SEK and EUR/NOK to move meaningfully lower

- think both AUD and NZD will significantly outperform JPY