The BOJ monetary policy meeting is Wednesday and Thursday, September 20 and 21

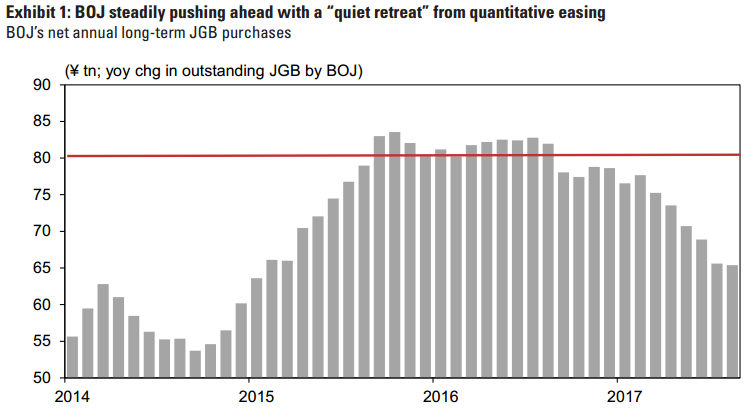

I am beginning to wonder when the Bank will formally abandon its 80tln yen target for JGB buying as it is irrelevant now the Bank has adopted its YCC control policy.

(Jargon watch ...

JGB = Japanese Government Bond

YCC = Yield Curve Control

)

I have been highlighting this for a number of months now, so it should not come as a surprise if the Bank do announce it. I expect there will be some sort of knee-jerk reaction in the yen anyway, despite it being well-flagged. If it comes I look for a move lower in USD/JPY at least on an announcement effect, and then a bounce back soon after.

Anyway, enough from me.

Goldman Sachs have a preview. As is usually the case from GS it's a long and detailed pice, but here it is in summary. The Q&A format is Goldman Sachs', bolding is mine:

Q1: What do you expect from the September MPM?

- A1: We expect the status quo. The September MPM marks the debut of two new policy members. We think for now they will vote in line with Governor Kuroda.

Q2: What steps would the BOJ take once it begins normalization?

- A2: Apart from reducing JGB purchases, which the BOJ has already begun doing, we would expect the BOJ to first raise its 10-year yield target, followed by the termination of its negative interest rate policy, and reduction of risk asset purchases.

Q3: Could the BOJ begin normalization before the 2% inflation target is reached?

- A3: Very likely. The BOJ likely wants to ensure it has room for future policy moves by starting to normalize interest rates while the US is still in a tightening cycle. Also, a protracted period of ultra-low interest rates will accumulate side effects on the health of financial institutions, regional banks and life insurers in particular.

Q4: What conditions would allow the BOJ to start normalization?

- A4: We think the BOJ would at least need to see new core CPI inflation (excluding energy and fresh food) stabilize above the 1% mark. Given that the BOJ has maintained that inflation expectations are formed adaptively, it could, under these conditions, argue that there is effectively no tightening in real interest rates.

Q5: Is it possible that the BOJ could miss the current US-led tightening cycle?

- A5: This is ultimately a question of whether Japan's inflation picks up enough before the current cycle of US rate hikes comes to an end. Barring any major adjustment to commitment under the new BOJ governor, however, we think there is a reasonable possibility that Japan could miss the current tightening cycle.

Q6: How does the government view the BOJ's normalization?

- A6: We believe the government supports it, but will have a strong incentive to limit the size of any rate hikes, given the resulting fiscal burden and the potential for the BOJ's financial loss to become a political issue.

--

Oh, and as a ps. ... this is from the GS preview, but it goes straight to the poiht I made about the Bank of Japan reducing its JGB purchases: