Highlights from draft documents leaking out

- Standard deduction doubled

- Would create a new family tax credit for $1600

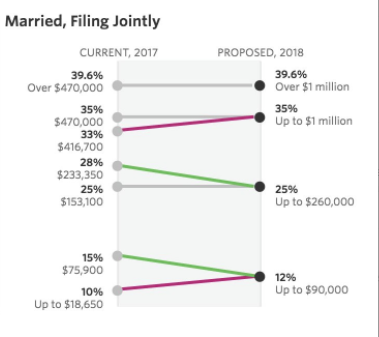

- Brackets at 12%, 25%, 35% and 39.6%

- The 39.6% bracket starts at $1 million for married couples (more than double prior $470K limit)

- Would maintain mortgage interest deduction for existing loans and new purchases up to $500,000

- Would maintain 401(K) and IRA plans

- Would repeal alternative minimum tax

- Would double exemption for estate tax, would repeal estate tax after six years

- Would lower corporate tax rate to 20% from 35%

- Would allow small businesses to write off loan interest

- New corporate tax limits on deductions for executive compensation

- A new tax on university endowments

- State/local property tax writeoff up to 10K

Sounds like a 20% corporate tax cut right off the bat, no phase in. That's good news but the biggest question is whether or not this is politically feasible and what it would mean for the deficit.

The spinsters are out and say the average family of four earning $59K per year would get a $1182 tax cut. That sounds significant.

Those lines on modernizing the international tax system and making a provision for repatriation are very good news for corporates.

Housing stocks are selling off on the mortgage interest deduction but there is lots of good news otherwise.

The full text isn't out, they just leaked this spin document which doesn't include any of the negative news.