HSBC's September Currency Outlook says that as the normalisation process begins from ultra loose policy, FX has acted as the benevolent central bank and delivered the initial tightening.

- USD and EUR have been used as the testing ground for tightening, rallying as the market anticipates tapering and rate hikes

- If our analysis is correct, then we need to seek out the central banks that are yet to turn the corner on policy.

- We believe the AUD, NZD, SEK and NOK will be the next to move as it becomes clear that these central banks are moving to a tighter policy.

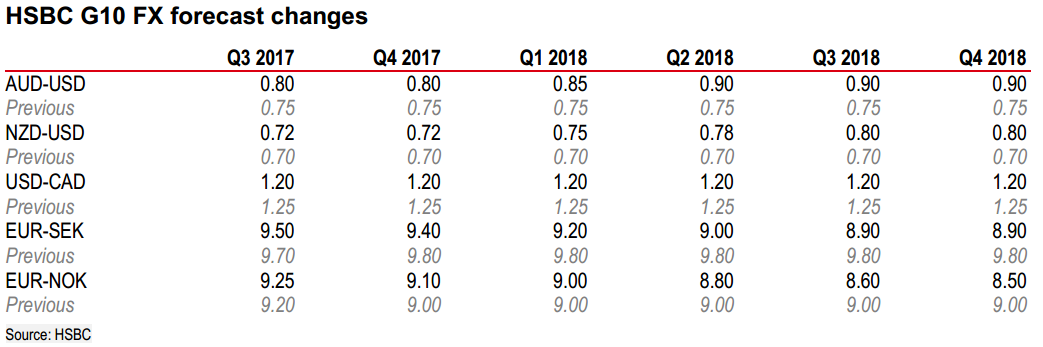

- We therefore revise our forecasts, looking for appreciation in all of these currencies.

Their forecast changes:

And, specifically on the EUR:

- The rally is largely complete. When the ECB actually reaches the exit, the currency adjustment will likely been done. The consensus is too late to the party, again. We see EUR-USD fluctuating around 1.20 over the next year.