Here's the latest weekly (from Friday) FX journal from Morgan Stanley

It's been a couple of weeks since I last saw their FX weekly and I did wonder about their running USDJPY long from 109.50 as it traded through their stop. Confirmation has just arrived but they're not giving up on the long side.

"We used the recent dip to buy USDJPY but were stopped out in holiday-related thin liquidity. We still like buying USDJPY on dips and would use a market-friendly outcome after Sunday's French election to reconsider buying. The JPY is likely to weaken as the global inflationary theme comes back onto the agenda, which our economists expect in the second half of this year. The upside in the JPY is limited by the BoJ's yield curve control strategy.

In summary, Japan's life insurance community currently holds foreign assets with a high FX hedge ratio. As the Fed hikes rates the cost to hedge may increase, meaning hedges may not be rolled over. The recent decline of hedging costs represents a one-time adjustment. We expect the USD-JPY rate and yield differential to rise from here. The major risk for the JPY is a market-unfriendly outcome from the French election, which pushes down EURJPY"

A new trade they've added to their portfolio is a short in AUDCAD.

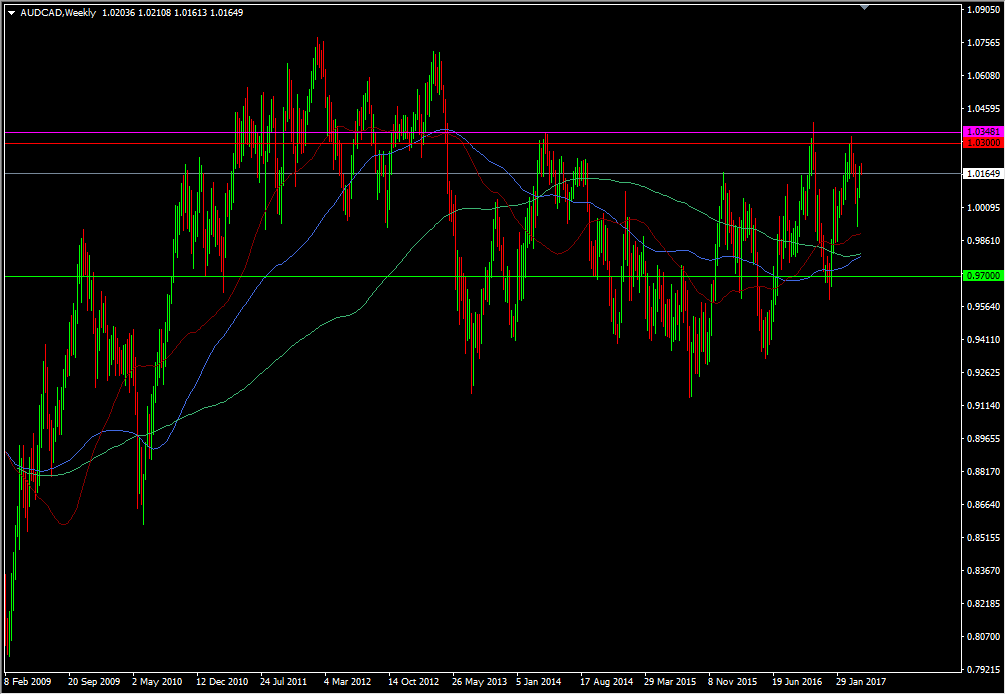

"Hold (Entry: 06-Apr-17)

Entry: 1.01; Target: 0.97; Stop: 1.03

Iron ore prices continue to head lower, in line with seasonal trends. We think there is further downside for the AUD and so keep this relative value trade. We cannot find a fundamental reason for the recent CAD underperformance apart from general worries about the domestic housing market. We don't expect the BoC to change policy even if more macroprudential measures are implemented.

In many respects, Australia and Canada are facing similar economic challenges: coming out of a commodity and investment slump, soaring house prices in major cities and low central bank rates. Recently, however, Canadian economic data has continued to outperform expectations, unlike Australia's.

The AUD/CAD rally since February is no longer justified on this measure. Inflation has not yet picked up significantly in either country, but we think the future possible path for downside is more significant in Australia. Wages have remained subdued as was noted by the RBA this week. In contrast, Canada's growth outlook is looking up, with Jan GDP beating expectations, coming in at 2.3%Y (1.9% expected).

Lastly, we highlight terms of trade differentials. Commodity markets can be volatile, but iron ore prices underperforming oil recently is not reflected in AUD/CAD. The risk to this view is a renewed rebound in iron ore prices on the back of increased Chinese demand."

Not that I look at this chart often (I didn't even have one on the go) but I think they could push the boat out on their stop by 50/60 pips just to incorporate April 2014 and March 2017 highs, and maybe even to the Nov 2016 high near 1.0400.

AUDCAD weekly chart

For their target, there's a lot of technical support down around 0.9993/4 (100 & 200 dma's), and 0.9790/0.9800 (100 & 200 wma's & 100 mma), so if it were I, I'd look to take some off around the dma's and the balance at the wma's. At least their target is more achievable than in AUDUSD, which they are also still short at 0.7540, SL 0.7760, TP 0.6900.

Any of you trading AUDCAD, feel free to add your own analysis.

Here's their brief for currencies this week.