I posted what the market expectations is, and a preview from Goldman Sachs here earlier:

More now via:

Barclays:

- We expect the October employment report to show a strong rebound in hiring after September data were suppressed by hurricane-related effects. At a decline of 33k last month, we estimate that the storms reduced growth in payroll employment by about 200k. Looking ahead to the October report, we expect nonfarm payrolls to rise by 325k.

- Our forecast is consistent with a quick retracement of storm-related effects, which is consistent with the signal from initial jobless claims and, indirectly, from other activity data that showed a quicker-than-expected bounce back in activity.

- Nearly all of this improvement should come in private sector payrolls and we expect private payrolls to rise by 320k, with the remainder coming in government payrolls. Within private payrolls, we look for a significant rebound in services employment and, in particular, leisure and hospitality employment.

- Elsewhere in the report, we look for the unemployment rate to hold steady at 4.2% and for average hourly earnings to rise by 0.2% m/m (2.6% y/y). We view at least part of last month's 0.5% m/m rise in hourly earnings as distorted by storm-related factors that either held back hours for salaried employees or reduced the numbers of hourly workers from the survey.

Westpac:

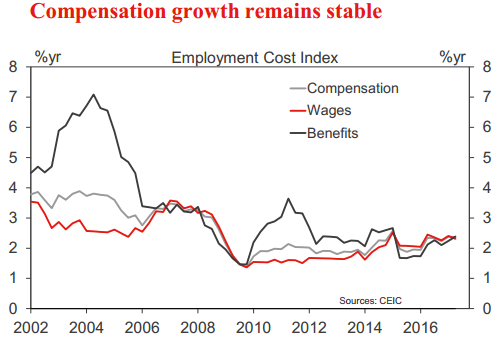

- The Employment Cost Index is the best gauge of overall wage and total compensation inflation in the US. In Q3, the annual rate is expected to hold around 2.5%.

- In contrast, a strong bounce is anticipated in nonfarm payrolls in October, 260k+, following the hurricane driven -33k print of September. Note that some of the rebound could also come in the form of a revision to September. The jump in household employment in September and an unemployment rate of 4.2% from the household survey (which was not affected by the weather) point to continued strength in the labour market which should be with us for some time yet.