The CME contract will launch December 18

The CFTC gave its blessing to Bitcoin futures and the CBOE contract will launch this week and the CME contract on December 18.

The CME is second to market but my guess is that the CME will win the battle for volumes. However, they may come to regret that if it goes badly.

Here are 5 major worries:

#1 - The hours

CME Bitcoin futures will open Sunday at 5 pm Chicago time and close at 4 pm on Friday. That leaves 49 hours where Bitcoin will trade but the futures market will be closed. Margin on the contract is 35% but in the last 48 hours Bitcoin has rallied 35.6%.

#2 - The contract size

The contract size is 5 Bitcoins, which is $77,885 at current prices. That puts initial margin at a minimum of nearly $28,000. That's a number that's far beyond retail traders. That's a good thing for financial stability but it's also likely far beyond what most Bitcoin miners could use to hedge.

#3 - The position limit

The position limit is 1,000 contracts, or 5,000 Bitcoin. That means someone could put on $75 million in exposure to Bitcoin with $26.25 million in margin.

#4 - Trading halts

This is a major worry. Here's what the CME says: "A price limit of 20% above or below the reference price and special price fluctuation limits equal to 7% above or below the reference price and 13% above or below the reference price apply. Trading will not be permitted outside of the 20% range above or below the reference price." That could leave the exchange in a very bad spot if prices move more than 20% on subsequent days. Trading would essentially not open and people would be stuck with massive losses (or gains).

#5 - It's cash settled

No Bitcoins will change hands at the CME. It's a cash-settled contract which means that if you buy a futures contract, you don't get 5 Bitcoins delivered to you at expiration. Instead, you get the difference between what you paid and what it's trading at. It's essentially like a big side-market where you bet on the price of something that no one has. Many futures markets work this way.

#6 - The reference rate

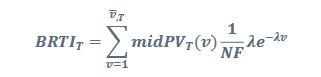

This is the big worry. The CME has designed the Bitcoin Reference Rate (BRR) and a Bitcoin Real Time Index (BRTI). The latter will be used to track price movements and is based on this equation.

You can read about it all here but what you need to know is that it's based on orderbook data, not trade data. It is composed of unmatched limit orders to buy or sell Bitcoin. That is a major potential problem because of spoofing, hacking, the lack of transparency at exchanges and other opportunities for fraud. The pricing data is also highly exclusionary, which means any exchanges that aren't updating fast enough will be excluded. With Bitstamp, GDAX, itBit and Kraken as the main providers, a problem at one or two (or all of them) could lead to serious price discrepancies. They will also be vulnerable to price manipulation at contract expiration.

So while a huge focus will be on the first days of trading, I think the real worry will be the final days of trading the first few contracts.