It's looking like the worst day for stock markets in awhile

S&P 500 futures are down 12 points and the yen has bounced back from yesterday's drubbing. It's a 'risk off' day in the same way that they happen now, not in the way it was 5 or 10-years ago, and definitely not like it was 30 years ago on Black Monday.

That was way before my time but the S&P 500 fell 20.5% that day in it's worst day ever. That's a lot, but to put it into perspective with this bull market. A fall that far today would take us a little bit below election night.

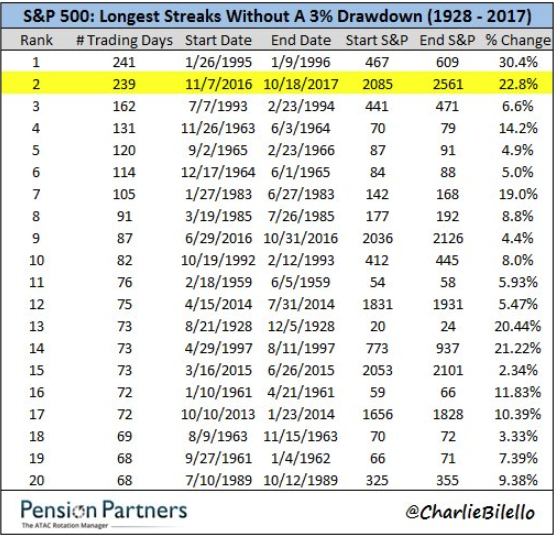

According to Pension Partners, the index hasn't had a 3% drawdown since then, which is 239 trading days, just two shy of the record set in 1995.

S&P futures are down 0.5%, which means it's a long way to go.

It is worth worrying about China. Stocks there were down slightly yesterday but the real trouble was in Hong Kong where the Hang Seng was down almost 2%.