This is a tiny snippet from Morgan Stanley's 'FX Pulse' for the week. Its their 'Bottom Line', so it's a worthwhile snippet!

Bottom line:

- The low yield, rising equity and commodity prices environment should keep EM assets supported.

- Global growth momentum has further strengthened, though political challenges in the US have led to it looking like a laggard and the USD selling off.

- Our MS positioning indicator shows the most extreme USD bearishness since its inception in 2009, suggesting that we should take a different approach.

- Trading dynamics in the 2004-2006 period remain our guide, with gradual policy tightening unlikely to undermine the economic expansion for now, resulting in investors seeking cheap funding and high asset returns.

- Carry trades should continue as long as inflation stays subdued below central bank targets.

- Unwinding yield-seeking trades requires us to see at least one of the following: inflation and wages breaking higher; US capital demand rising due to higher capex growth; or a credible package for tax reform.

- The US administration returning to anti-trade rhetoric should be on the radar screen for carry investors.

And, adding a bit - this is trade MS put on (July 14) on a 'money where mouth is' basis - it's a long USD trade.

Long USD/JPY

Hold (Entry: 14-Jul-17)

Entry: 112.50; Target: 118.00; Stop: 110.90

We think USDJPY should trade higher.

- Strong corporate earnings so far evidence the continued strong performance in global growth, and positive risk sentiment is bearish for JPY.

- USD positioning has reached extreme short levels which offers opportunities for upside surprises.

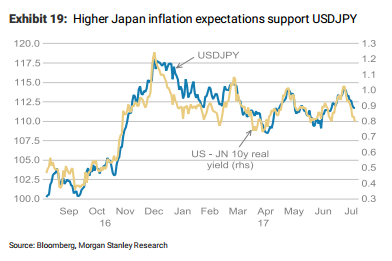

- Given the BoJ continues to hold Japanese yields at low levels and the likely continued normalization by the Fed, widening interest rate differentials should support the pair.

- Low yields in Japan should support continued capital outflows into higher-yielding global assets, which weekly data continue to confirm.

- We reiterate that the pain trade is the Fed delivering according to its dots with tighter policies pushed by ever-improving financial conditions.

- The JPY is the most sensitive currency within the G10 to US bond yields rising.

- The Nikkei is reporting that summer wage bonuses are expected to surpass 5% in the services sector.

- This is the fastest annual rise since 1990, which supports inflation expectations and a weakening JPY