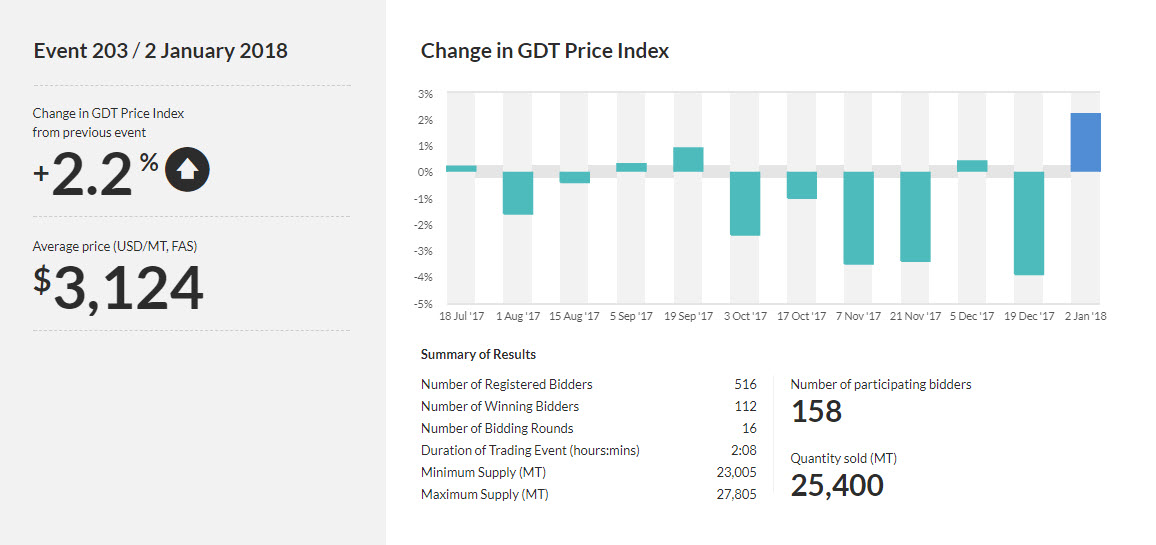

Prices rebound after sharp fall at the last auction

The Global Daily Trade price index from the most recent auction showed a 2.2% increase. That offset part of the -3.9% decline at the last auction. Prior to today's results, the last 5 of 6 auctions have seen prices fall.

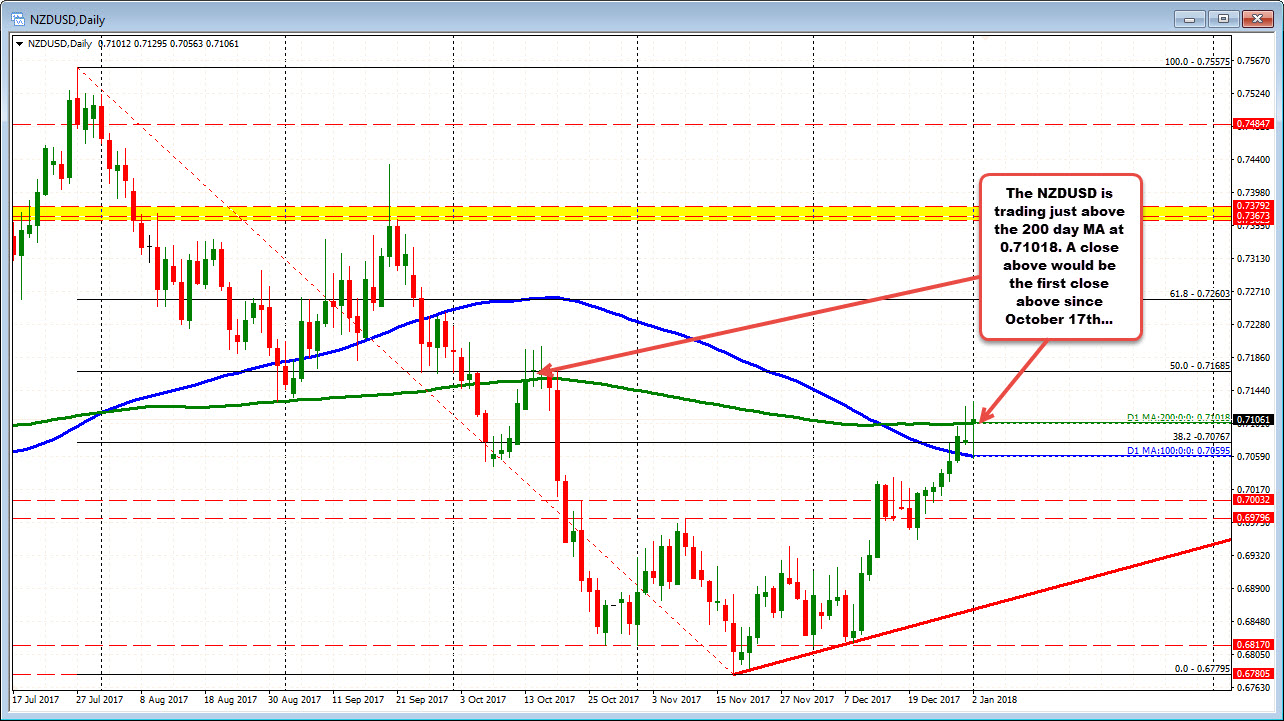

The price of the NZDUSD is higher on the day but off the peak. The pair moved above the 200 day MA once again (green line in the chart below) at 0.71018. It broke above the MA line on Friday but failed and closed back below the key MA line.

The high extended to 0.71295 - the highest level since October 19th. A close above the 200 day MA is more bullish. We currently trade at 0.7104 despite the increase in dairyprices. Can the 200 day MA support hold? If so, a move up toward the 0.71685 (50% of the move down from the July high) would be targeted. A move below the MA line and the buyers could give up and push the price back toward the 38.2% at 0.70677 and the 100 day MA at 0.70595 (blue line in the chart below).