Tomorrow morning (NZ time) the RBNZ's monetary policy announcement is due

- Accompanied by the Monetary Policy Statement (MPS) and media conference

Timing ... 2000 GMT Wednesday 07 February 2018 (which is Thursday morning NZ time) for the announcement (MPS)

- And 2100 GMT for Governor Spencer's new conference

- Later, due at 0000 GMT Spencer will speak in parliament (in front of a committee of

boofheadselected representatives)

Previews of what to expect (spoiler ... no change) .... bolding mine

via BNZ:

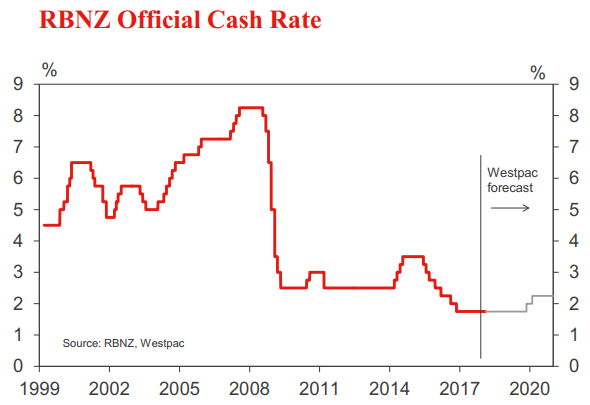

At Thursday's Monetary Policy Statement, we expect the RBNZ will largely stick with the OCR forecasts it had back in November. That is, no full first OCR hike until early 2020.

The information flow over the last couple of months might even argue, at the margin, for a softer track. However, this is balanced by

- 1) the sense there is already a strong precautionary element to the OCR setting,

- 2) the Bank's recent emphasis on the flexibility it has in guiding inflation to the mid-point of its target band

- and 3) the fact there are a number of identifiable inflation impulses on the near horizon.

This probably explains why the market is still looking for a first rate hike far earlier than the RBNZ has indicated - albeit that this expectation has drifted out into early 2019, from late 2018. We have also delayed our view on OCR hikes, to a February 2019 start point (while pushing our peak, still 3.00%, out to 2020).

Westpac:

- We expect the RBNZ to continue with its firmly neutral OCR outlook and repeat its long-held guidance that "Monetary policy will remain accommodative for a considerable period".

- Recent developments have been roughly neutral, with low inflation and the high exchange rate counterbalanced by a resurgent housing market and upwardly revised GDP.

- Foreign exchange markets may react to any comment about the exchange rate being too high, but interest rate markets are unlikely to be perturbed by a steady-as-she-goes MPS.