Jobs rose 209K in a roundly positive report

Steven Englander, Rafiki Capital:

"I think it is good but not good enough. You would have needed a little bit more strength on earnings and a little bit more strength on the NFP to convince the market. Now we are in a situation where we have of pretty good growth but still a flat Phillips curve. Where we are is, no pressure on short-term rates to go up really because you don't have inflation, and that reinforces that September looks good for balance sheet reduction.

"In terms of market dynamics, the fixed income market has priced itself into an extreme. The upward move we have seen in 10s and 2s will probably be retained. I think this will be seen as a dollar selling opportunity. Basically, that the dollar won't be able to keep its initial gains. I think there are still plenty of plenty of wannabe dollar sellers. In terms of the three year dollar accumulation cycle, that hasn't been fully unwound and there are still plenty of people looking to unwind it."

Royce Medes at CIBC:

"All told, the upside surprise on the headline number will be modestly positive for the U.S. dollar and negative for the fixed income, but this is still an important step in the right direction for Fed-watchers that had seen a soft opening to Q3 based on earlier-released survey measures."

Mohamed El-Erian, Allianz chief economic adviser:

"History tells me not to give up as yet, but the data has been disappointing. We are going through a soft patch, and it seems to be a prolonged soft patch," El-Erian said Friday in an interview on Bloomberg Television. "I'm getting more and more worried, but hopefully history will assert itself."

Bart Melek, head of commodities research at TD Securities:

On gold, "It looks like we'll be falling for the next few days."

Neil Jones, head of institutional FX sales at Mizuho:

"It's a Goldilocksy number... it may help keep USD/JPY gently bid."

Matt Boesler, Fed reporter at Bloomberg:

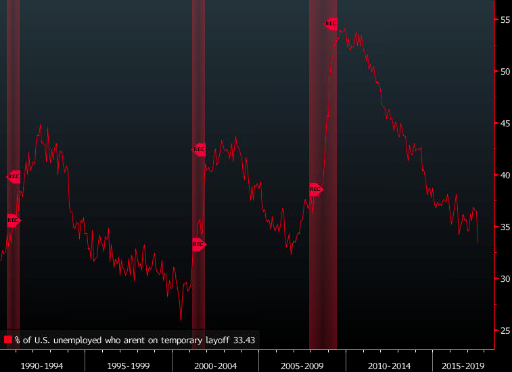

The composition of that 4.3 percent headline unemployment number is starting to look a lot better all of a sudden too: the percentage of unemployed workers who weren't just on temporary layoff plunged in July to 33.4 percent, the lowest since Nov. 2006

Neil Dutta Renaissance Macro:

"The labor market data seems consistent with an economy growing 2.5 to 3.0 percent, not 2.0 percent. With the forward market pricing in just a one-in-three chance of a rate hike in December, we'd advise taking short positions in the front end of the Treasury yield curve."

Bill Gross:

The Fed won't hike until core inflation hits 2%.

Tim Ghriskey, Solaris:

"It's a strong number. The market is reacting very positively to that. It was above expectations but not wildly above expectations. It's somewhat of a deceiving number because the participation rate stays low."

"Hourly earnings were in line. We're still not seeing wage growth. That means there's still workers part time or available but not counted in the unemployment rate."

"It's a good number and the market has reacted positively to it. It's a summer Friday in August and likely that means low volume. At least in the morning we're going to start out on a positive note and the market could set highs again."

Kathy Jones, chief fixed income strategist, Schwab:

"The market is most interested in average hourly earnings because that's the precursor to inflation at least historically. The wage gain is good in July but it is still tepid overall. The labor participation has ticked up. It's a very solid report but it's not going to change the market's expectations that there might be one more rate hike later this year. The problem is that you are adding a lot of jobs in the lower-waged jobs which is holding down the average. Bonds might turn flat before the weekend. The 10-year yield has been in such a tight range since March. It's very much a sideway market."