Its been a busy Tuesday, with more to come, but save some energy for Wednesday's jobs report from New Zealand

Due at 2145 GMT on Tuesday 31 October 2017 (which is Wednesday morning in NZ)

Q3 employment data

Previews

via Westpac:

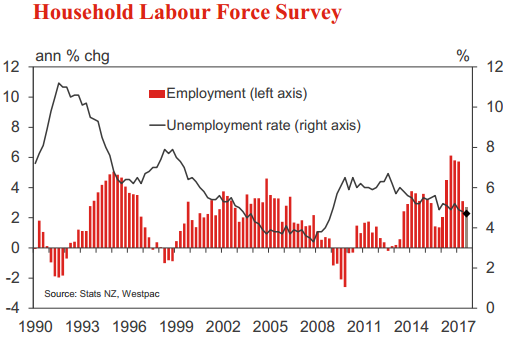

A range of indicators suggest that New Zealand's labour market has continued to strengthen this year, even as the wider economy has entered a period of slower growth.

- We expect the Household Labour Force Survey to show another modest decline in the unemployment rate to 4.7%, which would be the lowest since December 2008.

- Both employment and labour force participation are subject to quarterly volatility.

- This issue may have been exacerbated by a change to the survey in June 2016, which led to a one-off jump in the level of employment, but in doing so may have disrupted the seasonal pattern of the series.

- Our forecast of a strong rise in both employment and participation reflects payback for their unexpected declines in the June quarter.

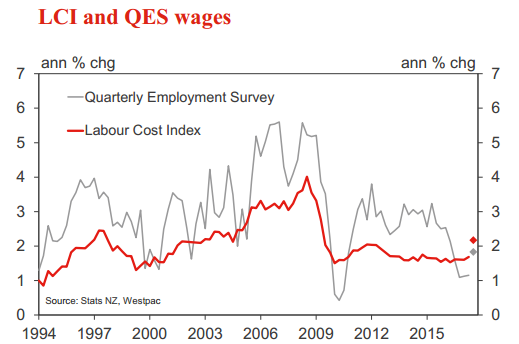

Westpac go on re labour costs:

With the labour market gradually tightening, and inflation no longer at rock-bottom levels, we expect to see a pickup in wage inflation over the next year or so. The process is likely to be a gradual one, though, as the Labour Cost Index tends to evolve slowly over time.

- However, the September quarter report is likely to see a substantial jump in labour cost inflation, due to the recent equal pay settlement for healthcare workers. (Our understanding is that this will show up in private sector wages, though it's publicly funded.)

- Excluding this effect, we expect to see a modest uptick in annual labour cost growth, from 1.7% to 1.8%. In the context of this slow-moving series, this would be a five-year high.

TD Securities:

- After the Q2 dip TD and the mkt look for a rebound in employment, in-line with the strong economy and leading indicators. It is also widely expected that the unemployment rate remains low, but we see downside to 4.6% as the participation rate remains at 70%, rise again.

- Q3 wages are expected to jump on a one-off deal, but with the minimum wage leap coming, permanently higher wages growth is on the cards now.

HSBC:

- We expect employment growth to have rebounded following the surprise drop in Q2.

- General activity indicators, including businesses' stated hiring intentions were at a high level overall in Q3, despite some uncertainty in the run-up to the election.

- The unemployment rate is expected to track gradually lower, while the wage measures are forecast to remain subdued in Q3.