We've had preliminary Q4 GDP from Japan already, with more economic growth data to come later from Europe

- Euro area Q4 GDP due at 1000 GMT

Previews (bolding mine):

Barclays:

- We look for euro area Q4 GDP to be confirmed at 0.6% q/q, with growth primarily supported by domestic demand, and in particular a rebound in investment.

- The net trade contribution should also be positive.

- Consistent with our slightly upgraded view on Italy, and under the assumption that Germany will expand 0.7% q/q in Q4 17 (14 February), we believe that the second print of euro area GDP (to be released along with Italy and Germany) may be revised up to 0.7% q/q from 0.6%

(dunno about this from Barclays - expecting 0.6 and 0.7% ... go figure)

RBC:

- The additional data that has become available since the first release of Q4 GDP does not suggest any revision to the initial estimate of growth of 0.6% q/q (vs. 0.7% q/q in Q3).

- The additional information that comes with this second release is a breakdown by country. Already we've had Q4 GDP for France (+0.6% q/q) and Spain (+0.7% q/q), with Germany and Italy to report this week. We expect growth to have slowed in both, to 0.6% q/q in Germany from 0.8% in Q3 and to 0.3% q/q in Italy from 0.4%. For the expenditure breakdown, we have to wait until the final release on March 7. One item worth noting is the signal from survey data vs. the actual Q4 growth outturn. Almost all of the survey indicators were consistent with growth accelerating in Q4 rather rhan the slight slowing we have seen. The latest surveys point to a pick-up in growth in Q1 2018, but, for the moment, we should probably view the signals they are giving on growth with a degree of caution.

Capital Economics:

- Q4 GDP to be unrevised

- We expect the "flash" estimate of euro-zone GDP in Q4 to confirm that the economy grew by 0.6%. The so-called "flash" release follows Eurostat's "preliminary flash" release at the end of last month, which showed that quarterly euro-zone GDP growth slowed from 0.7% in Q3 to 0.6% in Q4.

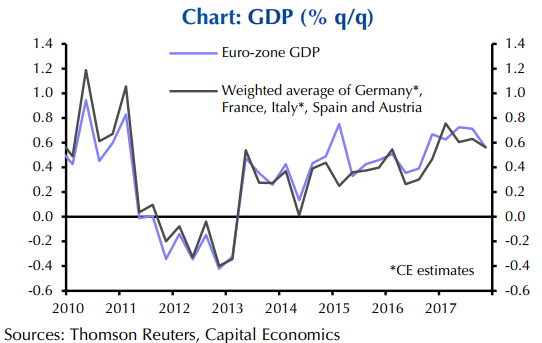

- Since then, retail sales data have been released that showed a fairly large fall in December. But industrial production data ... are likely to show an increase in the same month. We doubt that these data would prompt a revision to the preliminary flash estimate. After all, a weighted average of the national GDP data already published, and our forecasts for Germany and Italy, also points to quarterly growth of 0.6%. (See Chart.)

- That said, if the data are revised, they are perhaps more likely to be revised down. After all, GDP rose by just 0.56% in Q4. So it wouldn't take much to nudge that down to 0.5%, whereas it would take a bigger change to push it up to 0.7%.

---

Long live cryptocurrencies? Five insights from the ASAC Fund