I posted a preview up earlier from Nomura on the BoE meeting next week )August 3, 2017 - announcement due at 1100GMT)

The Bank of England meet next week - preview (20 reasons the MPC will hike rates)

A look now at Nomura's strategy going into the meeting. In brief, Nomura like a long GBP ...

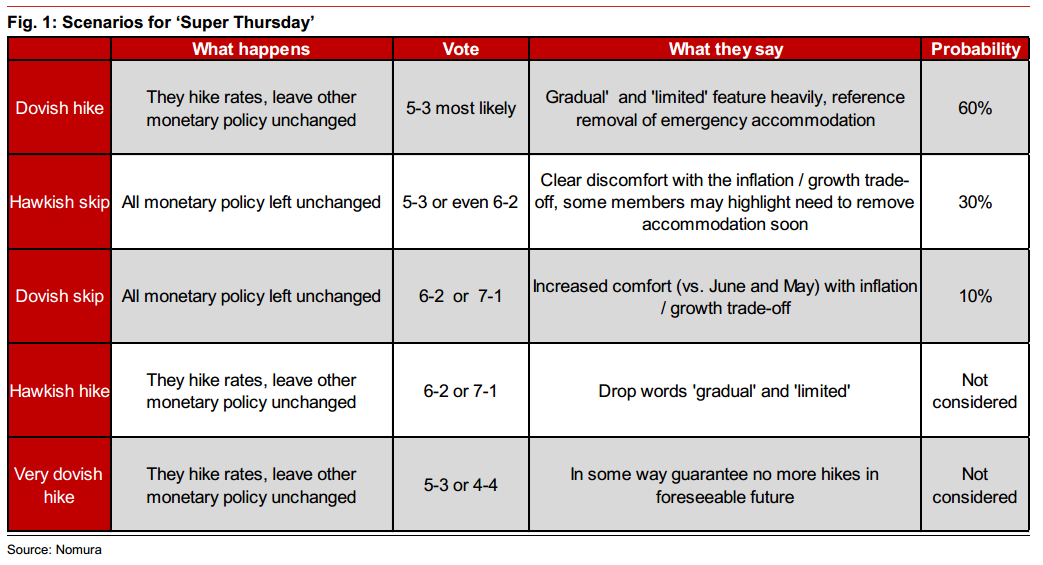

- The probability-weighted outcomes leave us short the front-end and with flatteners in rates, and long GBP.

- We also take a look at recent history of BoE meetings, where volatility has risen since Brexit and the introduction of 'Super Thursdays'.

- We conclude that current event pricing is too low.

On what to expect for GBP (in brief):

With 2W GBPUSD vol on a 7 handle the FX market is saying this is a "non-event."

- We disagree.

- At this meeting a better picture will be provided as to the current inflation and growth trade-off the MPC faces and which way that balance is shifting.

- No matter what the decision (hike or not) we think the market will judge whether the recent hawkish shift in BoE comments will fade away or is part of a set up for further rate hikes.

- Both therefore should be market moving.

For trading the event we recommend holding long GBP vs EUR and USD

- we have noticed moves in GBP over the BoE meetings keep on getting bigger

- Since Mark Carney's tenure and the introduction of "Super Thursday" (when we get the decision, minutes and inflation all at the same time, previously all three announcements were spread over two weeks) the average move in GBPUSD on BoE MPC days has increased to 0.61% vs 0.51% under Mark Carney in total and 0.41% since 2010