Factors for Oil bulls

Greg had the report on Friday that The Baker Hughes oil rigs was down to the lowest level since May 2018 reading 843 vs 853 signalling cuts for a second week in a row. See chart below too.

At the same time OPEC production numbers are showing a decent compliance with the OPEC deal. The United Arab Emirates has cut it's production to an average of 3.05MMbbls/d month on month vs it's agreed level of 3.07MMbbls/d over February. Saudi Arabia and Kuwait delivered on their supply cuts too. Russia showed production levels of 11.34MMbbls/d over February which was above it's agreed production levels of 11.19MMbbls/d. If general compliance continues , and the US rig count continues to fall, this will support US oil with more bids.

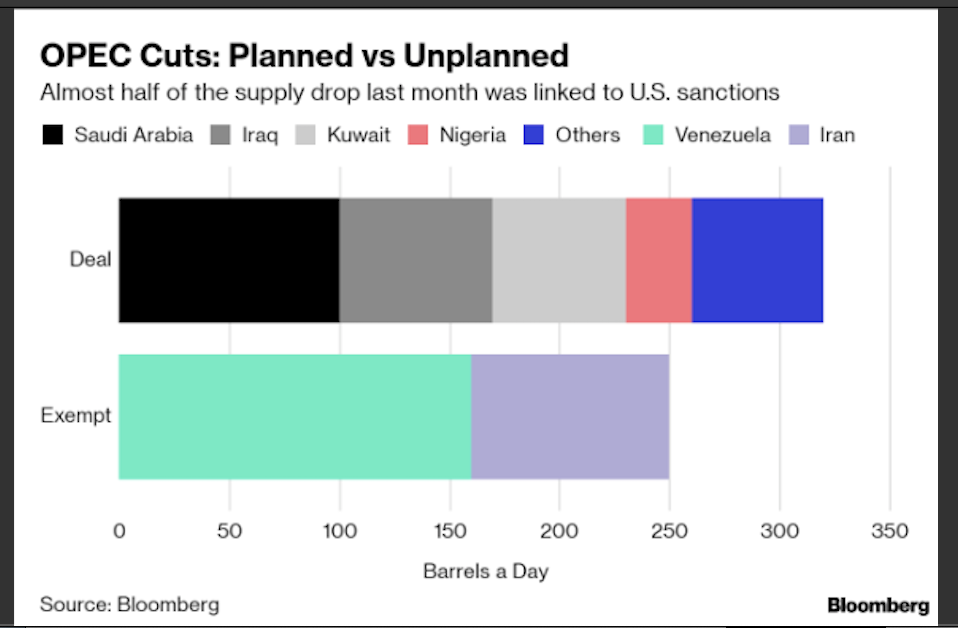

The other factors supporting US oil is the current supply cuts on Venezuala and Iran from US sanctions. I know Trump wanted OPEC to 'relax', but the supply cuts are heavily influenced by Trump's own sanctions. Hence I wrote the piece yesterday: US OIL: Trump is hoisted by his own petard. See Bloomberg's chart below on the source of lats month's supply cuts with nearly half a result of US sanctions.

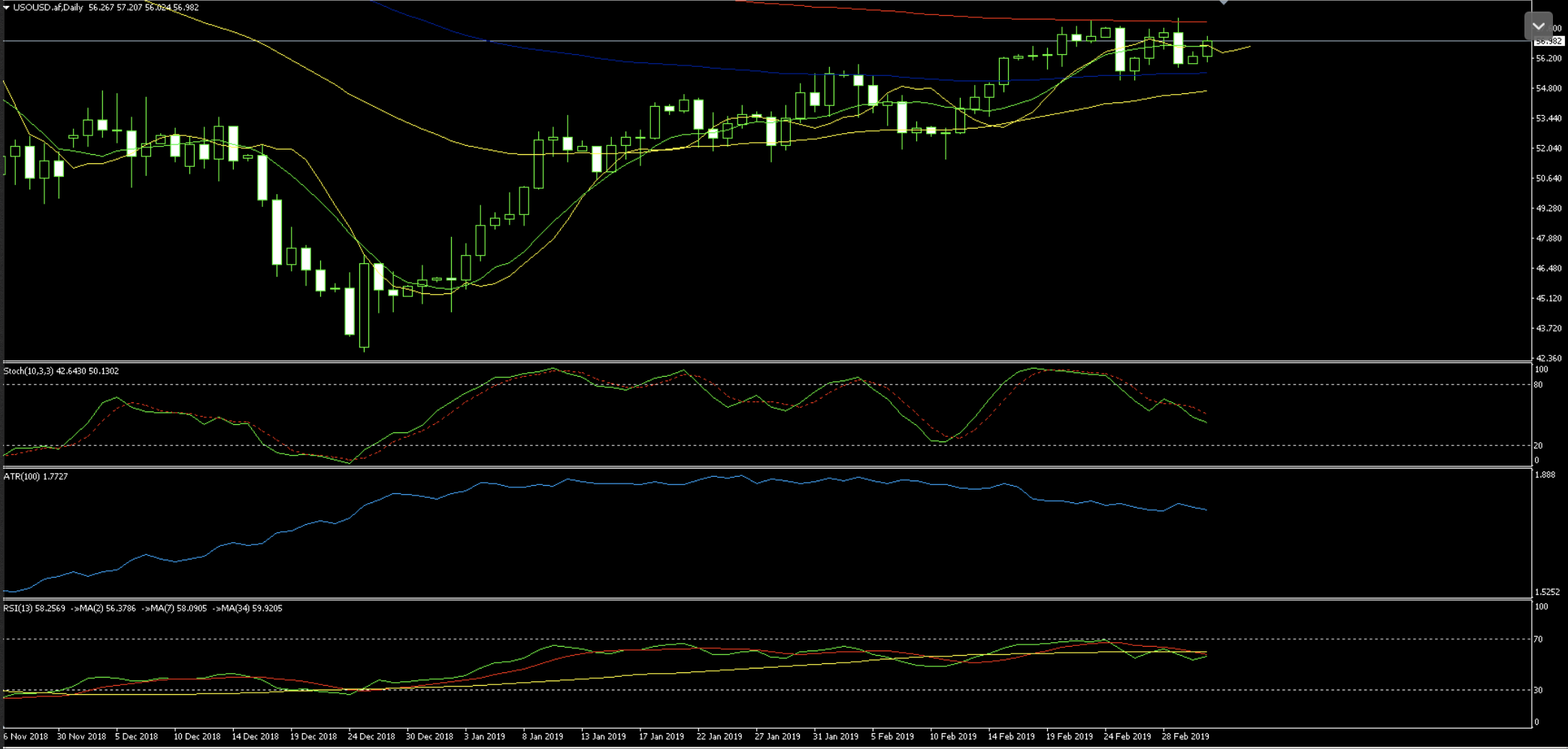

US Oil is currently sat between the 100 and 200 EMA on the daily chart and price will be influenced by either increased OPEC compliance and US oil rigs falling or the continuation or otherwise of US sanctions. Having a handle on these factors should help determine Oil's short term direction as these factors change. Remember that seasonally March has been a good month for US Oil too, so there are some seasonal factors at play as well.