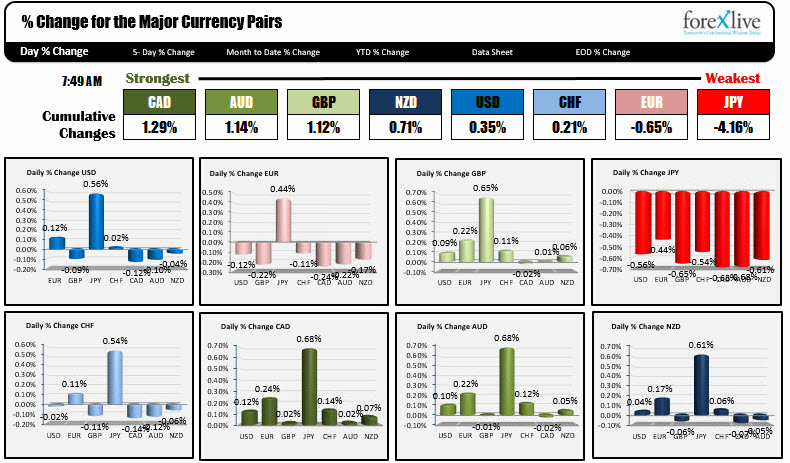

US dollar (sans the USDJPY) is hanging near closes from yesterday

As the market awaits the US non-farm payroll report, the JPY is the strongest while the JPY is the weakest. The USDJPY got a boost in the Asian session on the US/North Korean meeting news. That is the biggest mover vs. the greenback today. The other pairs vs the USD are plus or minus 0.12% or less from the closing levels. That is not a lot of wander. The USDCAD did continue to the downside (higher CAD) as the loonie continues the recovery post-tariff exemption news from late yesterday. Of course the Canada employment report will also be released today with a 21K net change in employment expected.

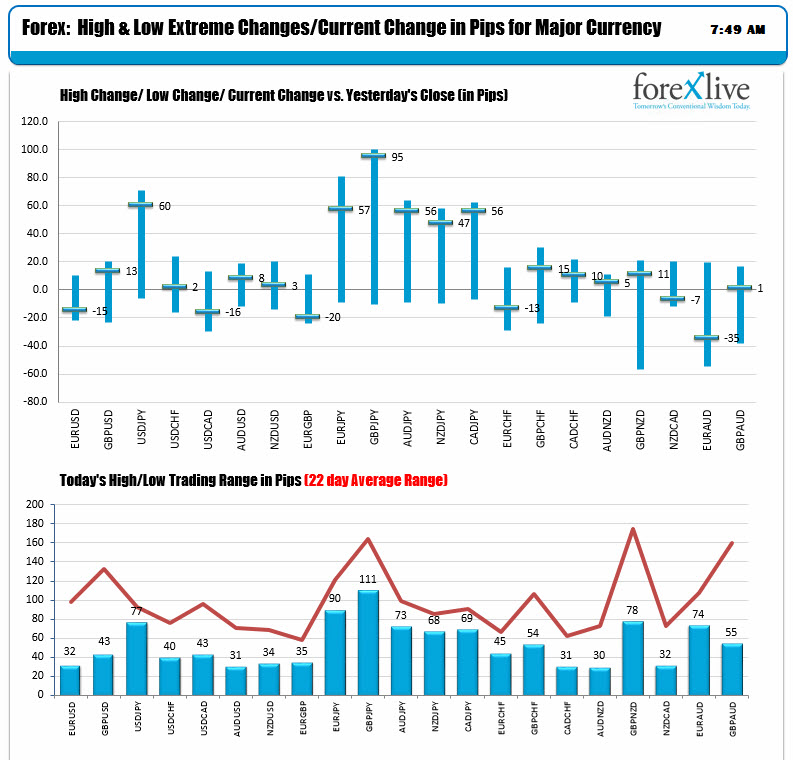

The ranges reflect the wait-and-see attitude. All the major pairs have trading ranges below the 22 day averages. The EURUSD has only a 32 pip range. The JPY pairs are the biggest movers and still trade near the highs for the day. As Mike has reminded you all this morning, there is a lot of option expires at 10 AM ET - especially in the USDJPY at 107.00. The best scenario for the sellers is to have their shorts expire at the strike price (expire at 0). If the shorts are in charge, it could put a lid on rallies. So far, they have done just that in the USDJPY . The high for the day reached 106.94 after the sharp run up. We currently trade at 106.84 - leaving some room for a rally on the employment report. It'll be interesting to see the price action.

A snapshot of other markets is showing:

- Spot gold $-3.40 or -0.26% at $1318.50

- WTI crude oil futures are up $.48 or 0.80% at $60.60

In the US stock market, the futures are implying

- Dow opening up 35 points

- S&P up 3.25 points

- NASDAQ futures up 13 points

In the US that market yields are higher:

- two-year 2.266%, +1.6 basis points

- five-year 2.65%, +1.8 basis points

- 10 year 2.875%, +1.8 basis points

- 30 year 3.142%, +2.0 basis points

In the European 10 year debt market yields are also higher

- Germany 0.647%, +1.9 basis points

- France 0.888%, +2.3 basis points

- UK 1.496%, +2.2 basis points

- Spain 1.425%, +1.7 basis points

- Italy 1.992%, +0.7 basis points

- Portugal 1.846%, +2.3 basis points