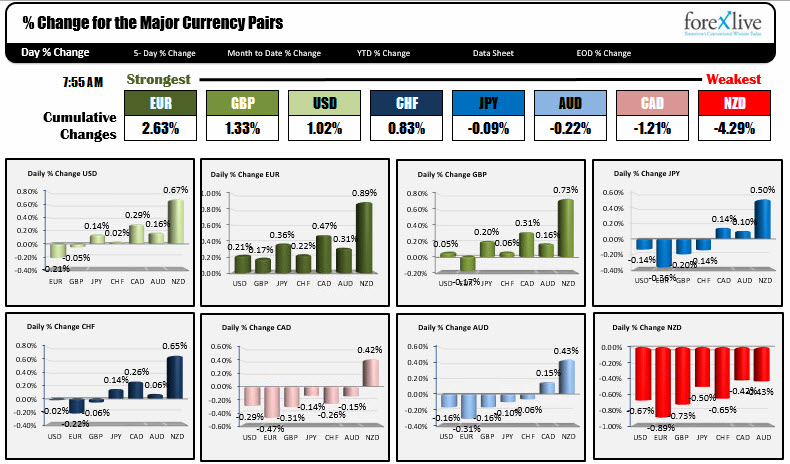

A snapshot of the strongest and weakest as the week begins

The snapshot of the strongest and weakest currencies are showing that the EUR is the strongest while the NZD is the weakest. The EURUSD has moved back above the 1.1800 level (traded as low as 1.17266 on Friday) and retraced to the 50% line on of the move down from Thursday's high at 1.1810 (the high reached 1.1813).

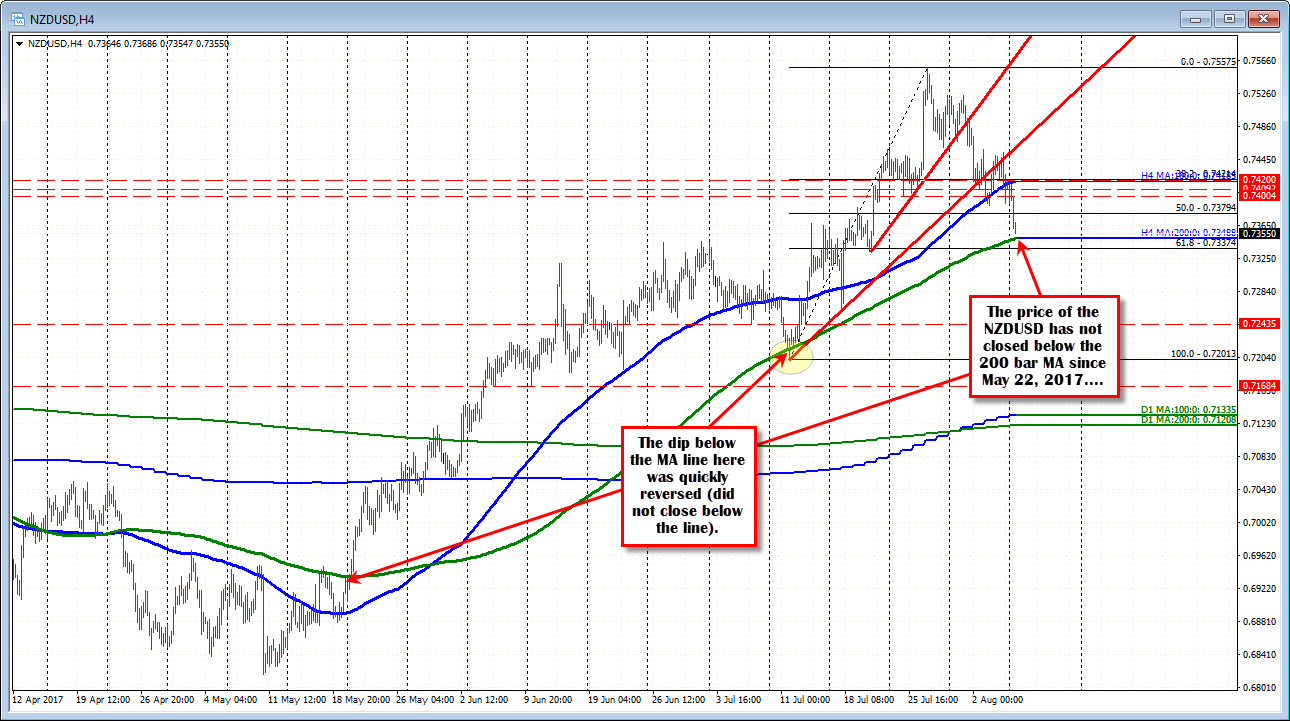

For the NZD, it has continued the run lower from Friday's trade. For the NZDUSD it approaches its 200 bar MA on the 4-hour chart at 0.73488 (the low reached 0.7355). The price last fell below this MA line on July 11th for one single bar (did not close below the line though). The last close below the 200 bar MA on the 4-hour chart was back on May 22, 2107.

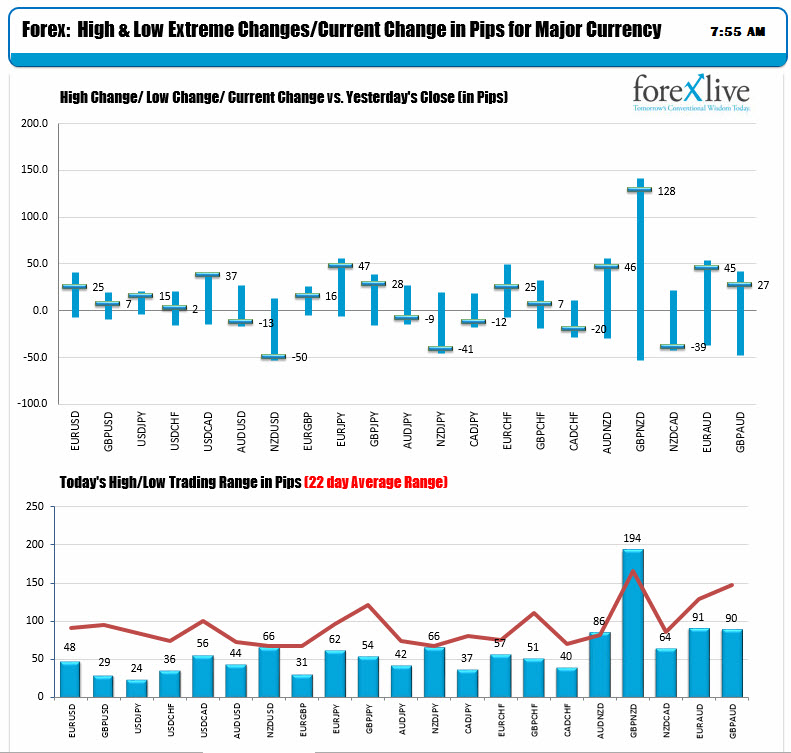

The ranges against the USD with the exception of the NZDUSD, are showing the dull market conditions. The GBPUSD and the USDJPY both have trading ranges less than 30 pips. That is not a lot and is well below the 22 day MA (red line in the lower chart - represents about a month of trading). The USDCAD is the next most active pair. It continues it's move higher and also trades near the day's high.

In other markets right now:

- Spot gold is down -$2.20 to $1256.20

- WTI crude oil is down -$0.61 to $48.97

- US yields are higher. 2 year up 1.2 bp to 1.362%. 10 year up 1.4 bp to 2.276%. 30 year up 0.6 bp to 2.849%

- US stock futures are higher. S&P futures are up 2 points. . Nasdaq futures are up 9 points. Dow futures are up 26 points.

- European stocks are mixed. German Dax -0.4%, France CAC -0.2%, UK FTSE up 0.2%

- European 10 year yields: Germany unchanged. France unchanged. UK down -1.8 bp. Italy -1.4 bp. Spain -1.4 bp.