A preview with a difference via ING for the Federal Open Market Committee coming up today

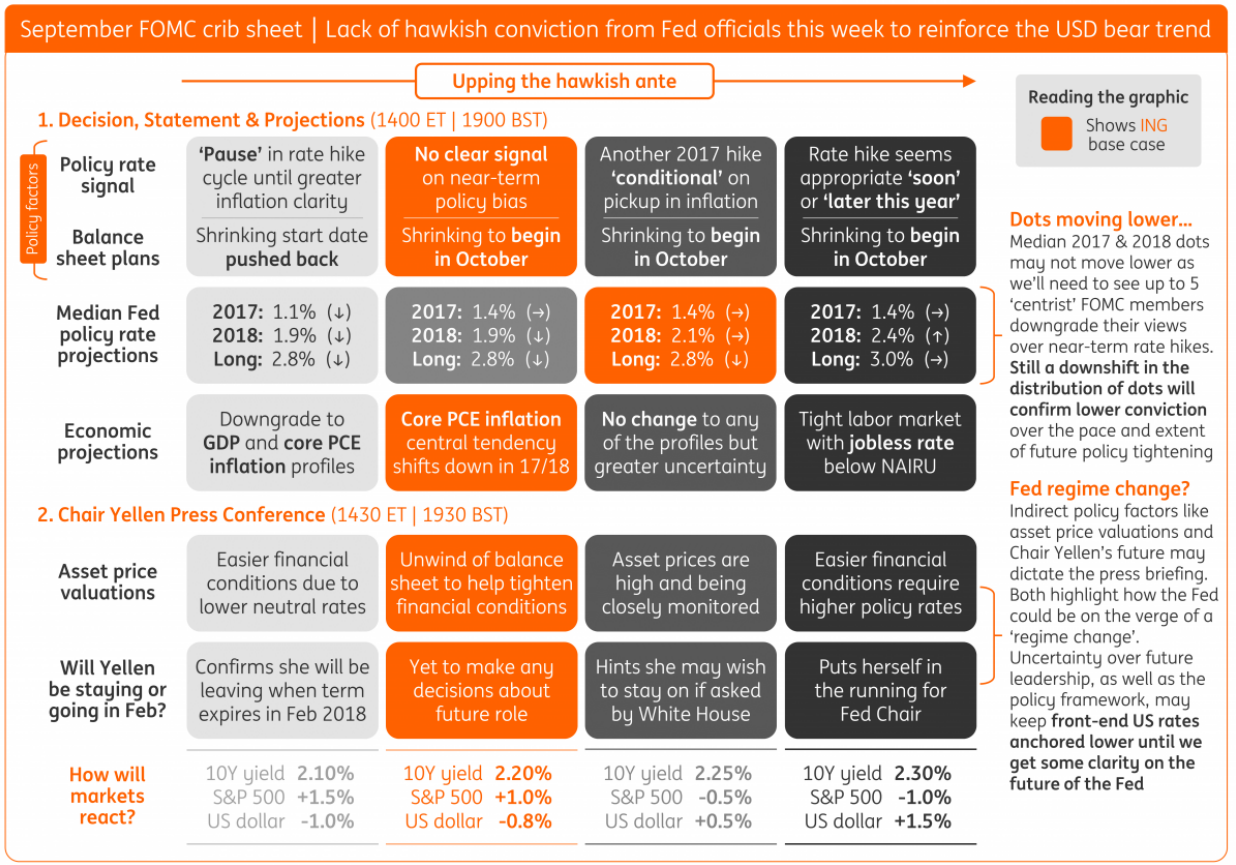

First, their 'crib sheet', a very handy infographic:

And, says ING (bolding mine ... and point 2 shocked me!):

1. Fed's dot plot likely to go through a downgrade - The balance of risks suggests there is more evidence for the dovish camp within the FOMC.

- the short-run disruptive effects of Hurricane Harvey (and potentially Irma)

- North Korea-related geopolitical tensions

- lacklustre US inflation dynamics

2. While we do not expect US yields or the USD to move much on what would be a well-telegraphed balance sheet announcement this week, there is a non-trivial risk of the Fed delaying this process. One of the pre-conditions Chair Yellen had stipulated back in March was the need for solid underlying momentum in the US economy, and recent weather-related disruptions may give officials a reason to hold fire

A delay ... I'd be shocked. OK, moving on ....

3. Rate increases won't necessarily tighten financial conditions

An FOMC member floated the ... view that elevated risky asset prices were a response to markets adjusting to structurally lower neutral interest rates - a factor which the Fed cannot control. This implies that in the absence of inflation, there may be little need for additional Fed rate hikes to tighten financial conditions.

4. Chair Yellen's future is also likely to come up in the press briefing ... The most market-friendly outcome at this stage is if Chair Yellen stays on beyond her term

5. The USD typically moves lower post-FOMC meetings

In the absence of any convincing hawkish signal -such as a reference to another rate hike being 'appropriate soon' - we think the USD is likely to follow the historical pattern of moving lower in the aftermath of the FOMC meeting.