The USD is mostly higher

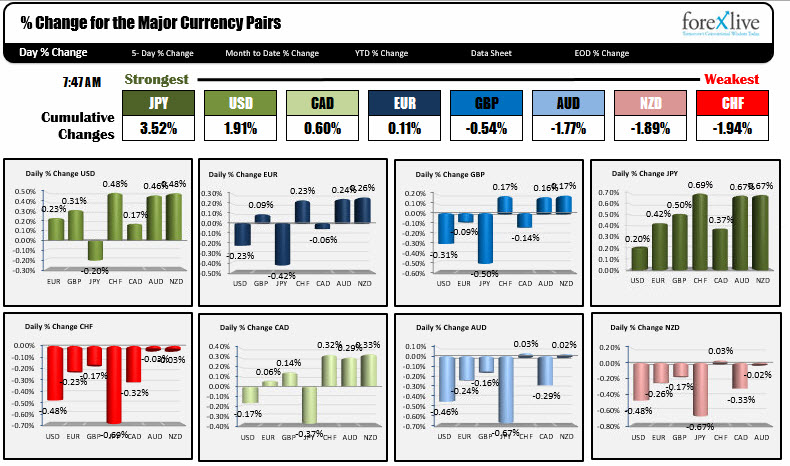

The JPY is the strongest currency as NA traders enter for the day, while the CHF is the weakest. The USD is higher vs. all the major currencies with the exception of the JPY.

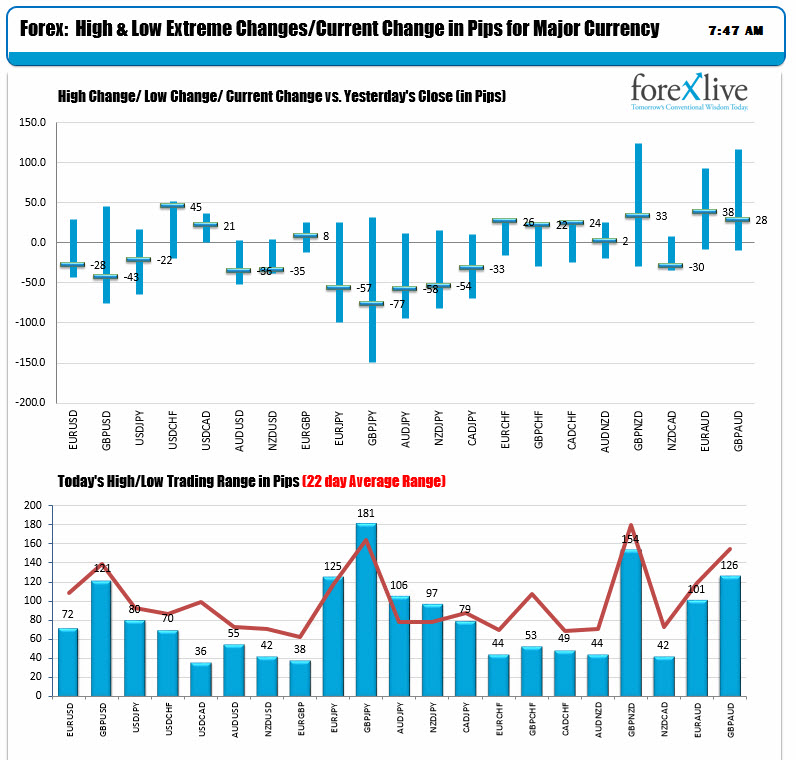

The volatility is lower in pairs vs the USD. The ranges for the day are less than the 22 day average (red line in the lower chart. 22 days is about 1 month of trading days). There is more volatility in the JPY crosses like the EURJPY, GBPJPY, AUDJPY and NZDJPY. Stocks continue to be volatile which can whip the JPY pairs around. The fair value of the Dow was showing a -300 point decline earlier in the day. The current fair value is -150. The Nasdaq futures and S&P futures are also projecting lower openings.

In other markets, the snapshot is showing:

- Spot gold is trading down $.72 or -0.05% at $1323.40

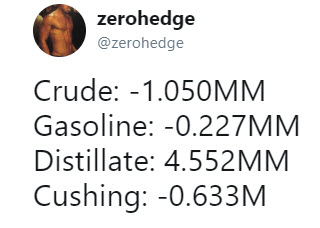

- WTI crude oil futures are trading down $.21 or -0.33% at $63.19. The inventory data will be released later this morning. Below are the estimates from the private data late yesterday. The survey on Bloomberg is showing an add of 3150K in crude and a 50 add in gas. So the private data and the estimates are not in synch.

- Bitcoin on Coinbase is up about $500 and trades just above the the 200 day MA again at 7969.41 (trades at $8295).

- US yields are lower but by less than 1 bp. Two year 2.097%, -0.8 basis points. Five-year 2.5312%, -0.8 basis points. 10 year 2.792%, -0.9 basis points. 30 year 3.056%, -0.9 bases's