The BOE's rhetoric from today's meeting sees rate hike expectations jump

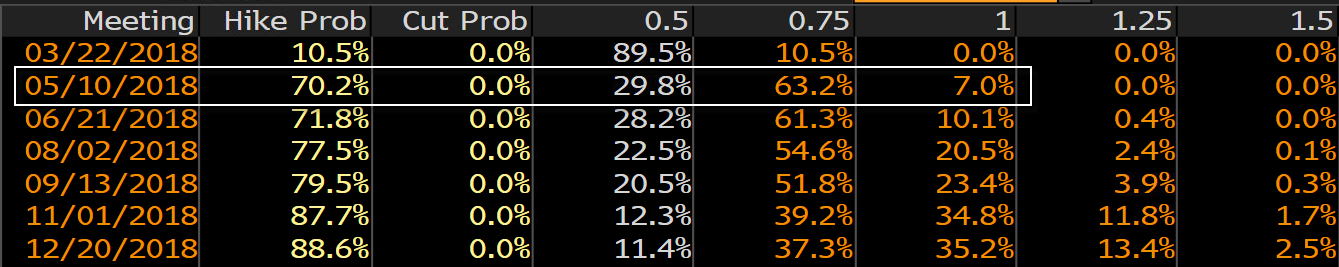

The market is looking for a May rate hike for the BOE at the moment, and the odds of a hike priced in by the OIS market has jumped to 70.2% from under 50% before the meeting.

Carney did mention that monetary policy changes will depend on data - saying that "timing of the next rate hike will depend on economic data" - so between now and then inflation and consumer data points are going to be paramount.

Not only that, Brexit news will also play a part in all of this as well according to Carney so there's a chance that expectations are going to jump all over the place if we start seeing things get a little messy.

Anyway, we won't have to wait long for the first check point on the data front, as we'll be getting UK January inflation data next week on 13 February, followed by the wage/earnings data on 21 February. So, be on the look out for these two data points later this month.