Bloomberg outlines three points of evidence as to why the ECB is justified to not tweak its language in its upcoming meeting on 8 March

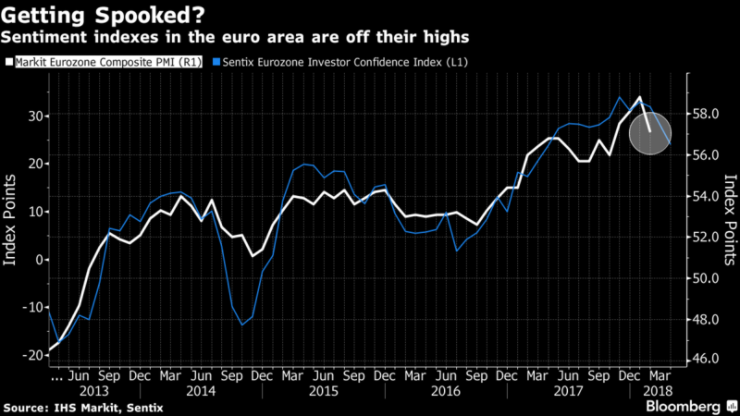

The first of which is the data points from the manufacturing, services, and composite PMIs. For the Eurozone data and key nations (Germany and France), we're seeing a slight slowdown (or a speed bump if you would call it one) and that raises the question whether or not the peak of Eurozone economic growth has already been surpassed at the end of last year.

The second point they highlight is the fact that Trump's plan to impose tariffs has raised the specter of a global trade war, and his threats over the weekend to the EU creates more uncertain elements that could destabilise markets even more than they already have.

The final point is that the anti-establishment surge in Italy raises questions over the political outlook on one of the Eurozone's more prominent economy, and uncertainty surrounding the future government in Italy is something the ECB will want to wait to clear up before making its next move.

In short, they're all valid points and the ECB has time to go about in tweaking its forward guidance message to the market so there's no need to rush things in my view. The only real issue is that they get too complacent and the market gets impatient, but it's only March and we still have quite some way to go. Besides, Trump getting the market to focus on trade talks is a welcome distraction for the ECB as it puts less pressure and scrutiny on them this week.

Here was Bloomberg's economists forecast on the meeting this week, ICYMI.