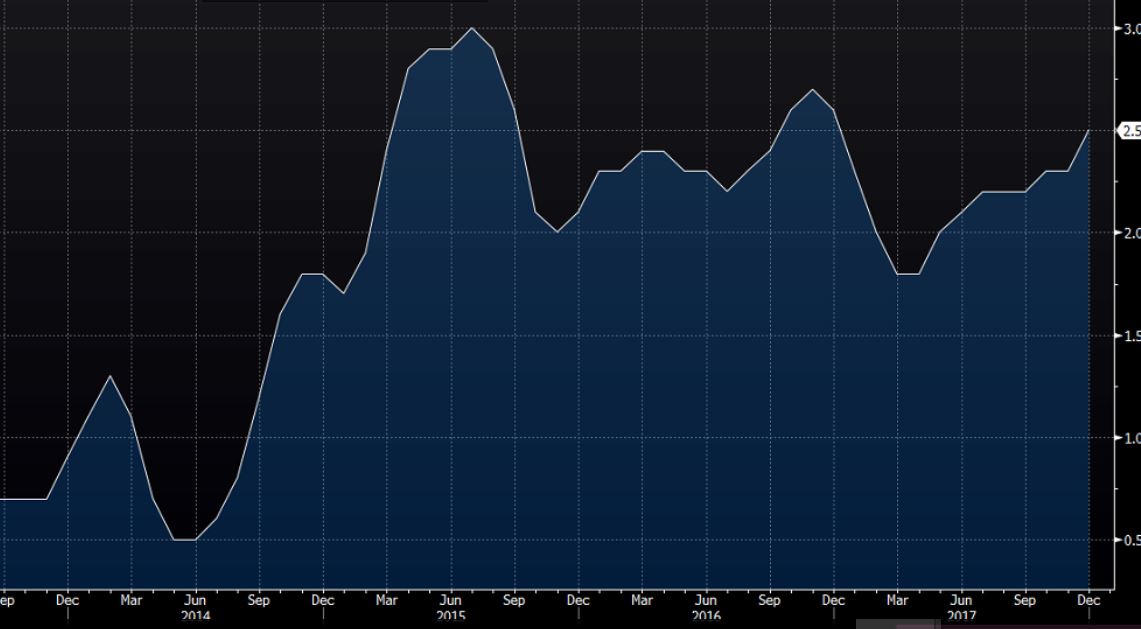

UK wages and jobs data now out 21 Feb

- 2.5% prev

- earnings ex bonus 3mth/yr 2.5% vs 2.4% exp vs 2.3% prev revised down from 2.4%

- Jan employment change 3mth 88k vs 165k exp

- jobless claims change -7.2k vs 6.2k prev revised down from 8.6k

- unemployment rate 4.4% vs 4.3% exp/prev

- claimant count rate 2.3% vs 2.4% prev

Soggy report overall with softer jobs data outstripping steady wages sees GBPUSD down to 1.3927 and EURGBP up testing 0.8850 with GBPJPY continuing its slide to look at 149.75 support/demand.

Steady/improving wages as a stand-alone piece of data maybe but still behind the rate of inflation and that will remain a concern to consumers, govt and BOE alike. First rise in unemployment rate for almost 2 years.

GBP still ranging so I don't think we're breaking out any time soon and not on this data. Jury still out on BOE rate hike in May

Says the ONS on jobs:

- Latest estimates from the Labour Force Survey show that following a period of a continuous decline, the number of unemployed people increased by 46,000 to 1.47 million in the three months to December 2017 when compared with July to September 2017. As a result, the unemployment rate rose by 0.1 percentage points to 4.4% in the three months to December 2017, compared with the three months to September 2017

- Approximately two-thirds of the net increase in unemployment can be attributed to the people in the younger age groups, namely 16 to 17 and 18- to 24-year-olds. On the one hand, these age groups exhibit higher volatility.

- On the other, the direction of the change was consistent across all age groups, which raises a question of whether unemployment reached its minimum and will either grow or remain at a broadly stable level in 2018. It is worth remembering that the unemployment rate is still 0.4 percentage points lower than in the three months to December 2016.

Full report from ONS here

UK core wages 3mth/Yr