A little heads up on the UK November inflation numbers to come and what to expect

Here are some of the data points and what is expected of the market:

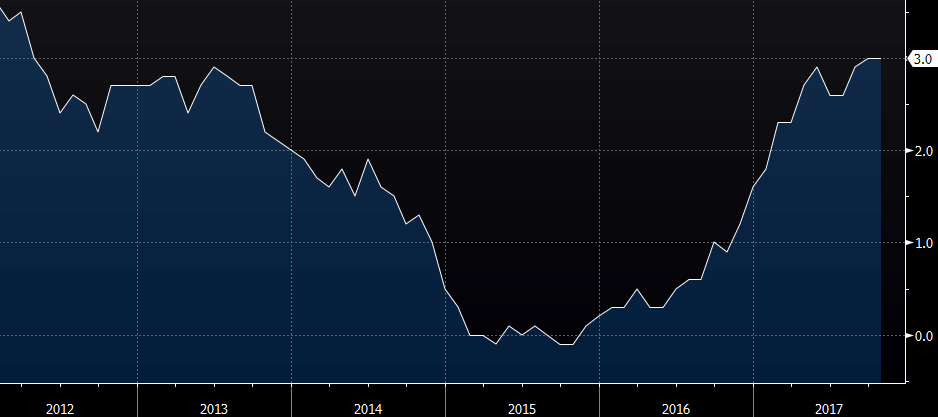

- CPI y/y 3.0% expected; prior 3.0%

- CPI m/m +0.2% expected; prior +0.1%

- Core CPI y/y 2.7% expected; prior 2.7%

That's with regards to inflation readings that the BOE is focused on. At 3.0% y/y, it's the highest reading in 5 years. And this owes no thanks to Brexit causing a weaker pound. A higher inflation rate than expected may prompt traders to believe that the BOE will have to move sooner to raise rates again. Right now, the market is expecting the BOE to stay pat for the time being and let things play out - since they raised rates in November.

Also, if the reading comes in at 0.1% higher then BOE governor Mark Carney has to write a letter to the UK Treasury to explain why inflation is overshooting the 2% benchmark that most central banks adopt.

- RPI y/y 4.0% expected; prior 4.0%

- RPI m/m +0.3% expected; prior +0.1%

The retail price index is basically a measure of inflation on certain UK public sector activities. Not really an important statistic, but good-to-know the trend in inflation in general.

- PPI input y/y 6.7% expected; prior 4.6%

- PPI output y/y 3.0% expected; prior 2.8%

Producer prices are expected to jump as well as the weakened pound is likely to translate to more expensive imports, which means input prices will be higher. Then, part of that will be passed on to output prices as well - so that is expected to go higher too.

PPI numbers are not the focus here as well, but it's another data point to keep in check with to know how things are doing in the economy in general.

Like in the case of the UK, you see rising PPI numbers and inflation, but wages are stagnating. That means less disposable income for the general public - and that translates to less stimulus for economic growth. All this of course is conjecture, just a simple showing of why these numbers may matter.