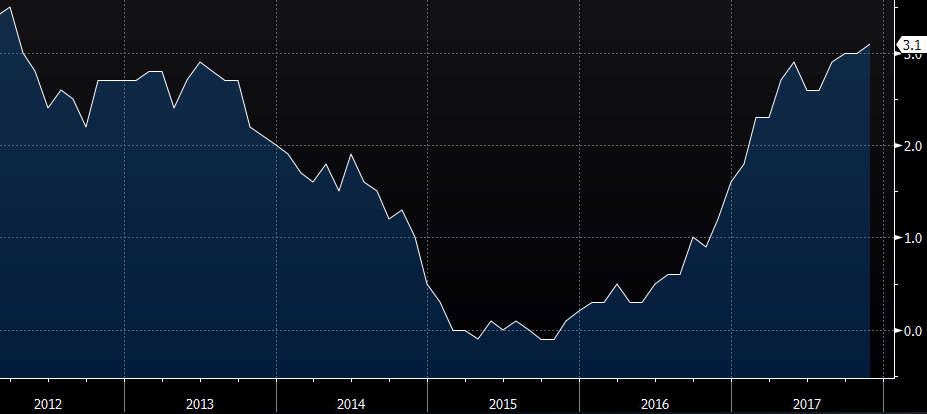

Latest data released by ONS - 12 December 2017

- Prior 3.0% y/y

- CPI m/m +0.3% vs +0.2% expected

- Core CPI y/y 2.7% vs 2.7% expected

- RPI y/y 3.9% vs 4.0% expected

- RPI m/m +0.2% vs +0.3% expected

- Retail price index 275.8 vs 276.1 expected

A higher than expected reading. Pound relatively perky, still. GBP/USD jumped to 1.3372, but a very minor reaction if you look at it.

Now back down to 1.3363. Looks like Carney has some explaining to do to the UK Treasury.

Anyway, back to the release. This is the highest reading since March 2012. The boost in the reading mainly came from air fares which fell between October and November but by less compared to a year ago.

Rising prices from computer games (!) also had an upward effect.

The ONS report can be found here.

Despite being higher than expected, it's not really a game changer to the BOE - unless of course the trend persists and it moves further away from the 2% level - but as I mentioned in my preview, it may cause certain quarters in the market to factor in a faster rate hike.

GBP/USD now back up to 1.3373 - briefly touching 1.3380.